How to Calculate Cross Rate of Exchange? Cody Walls Believe it or

Millennium Development Goals (MDGs)

People who are finally starting to get comfortable with fx trading might be familiar with the term Forex Lots. For those who are unaware, forex lots are merely the number of currency units that a trader buys or sells.

Understanding what lots are, what they do, how to calculate lots, use them, etc is vital for any trader.

Read on to find out what forex lots are, what their sizes are, and how you should go about calculating them.

Source: https://www.quora.com/What-is-a-lot-in-Forex

As we said earlier, lots are the number of currency units that a trader acquires to trade in currency. Some research and planning have to be done by the trader to be able to choose the perfect lot size for their investment.

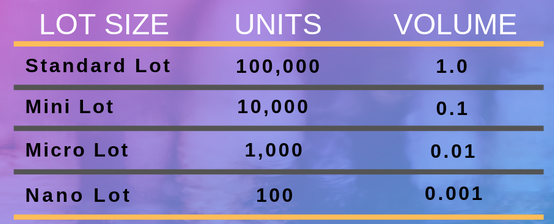

The average lot size on the fx trading market is said to be 100,000 units. This is called the standard lot. You can also get mini lots that are 10,000 units, Micro lots that are 1,000 units, and Nano lots that are less than 1,000 units.

For example, if you were to buy a single lot (100,000 units) of NZD/USD which is currently at 0.64, you will pay 640,000 USD and get 100,000 units of New Zealand dollars. This is how you measure a “lot size” and how much money you’ll have to pay for it.

It should be noted that some brokers use lots to represent quantity and some brokers prefer the actual currency to display quantity.

Source: https://wallpapercave.com/trading-wallpapers

As mentioned earlier, there are numerous lot sizes available to fx traders and they are free to purchase any of those lot sizes as per their trading requirements. One can easily do their research on these different lot sizes and determine which one to go for.

We will discuss in detail the reasons for their selection while purchasing lot sizes.

Micro Lots: Micro lots are the smallest lot sizes available to traders on the fx market. One micro-lot is worth 1,000 units in the currency in which you’re trading in.

Needless to say, they are the cheapest of all the lot sizes available and are perfect for beginners who are looking to get their hands wet and gain some experience with forex lots.

Mini Lots: After the micro-lots are the mini lots. One mini-lot is valued at 10,000 of the base currency In which you wish to trade.

For example, if the default currency of your account is USD and you are also trading in a dollar-based pair, then the value of each pip (Price Interest Point) will be $1.00.

Those who have accumulated sufficient experience in micro-lots and have a good capital to invest can opt for the mini-lots.

Standard Lots: They are the costliest lots and a single standard lot stands at 100,000 units of the base currency of your trades. If you are trading in USD then that would stand at about $100,000. If we take a look at the pip size then you’ll observe that it is $10 per pip on average.

Trading on standard lots isn’t that common as people often go for the safest bet and choose the micro or mini-lots to save their investment capital.

As we mentioned earlier, traders usually choose the micro-lots when they are starting as a beginner to be on the safe size and conserve as much capital as they can.

Traders with more experience and capital to spend can opt for the mini lots or the standard lots depending on their trade position requirements.

Source: https://www.babypips.com/tools/position-size-calculator

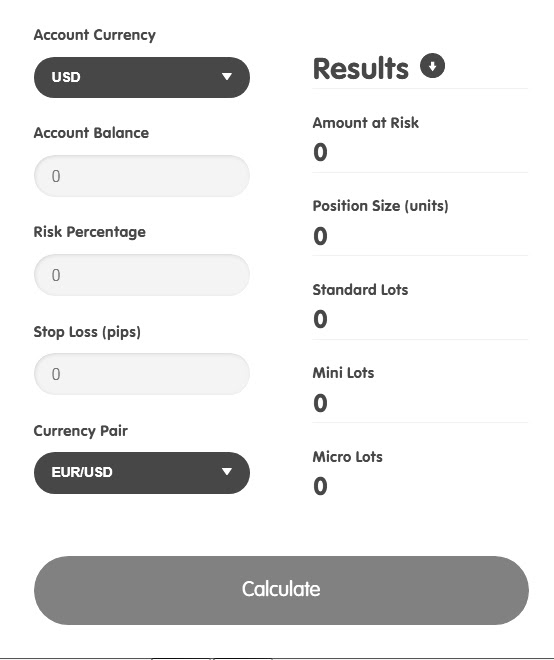

You can also use numerous tools that are available to you for free to calculate your required lot size accurately. You only have to feed the lot size calculator with relevant numbers and it will calculate the approximate amount of currency unit that you need to purchase or sell.

Tools like lot size calculators go a long way in helping traders manage their risk while trading as determining the accurate position size helps you keep your position risk at a minimum.

Most online lot size calculators will require you to enter a few fields with accurate numbers such as the size of your account, what currency pair you’re trading in, the percentage of your account that you are willing to risk per those trades, etc. Once the details are in, the calculator will do its work for you.

The image above depicts what a common forex lot size calculator looks like. There are numerous online calculators available for forex traders to use that are similar to this one.

Source: https://www.learntotradethemarket.com/blog/become-successful-trader-act-successful-person

Tools such as indicators and size calculators are essential for a trader’s arsenal of helpers that make their trading experience a whole lot easier.

One of the main reasons for using a calculator in the first place is to save time and get the most accurate results. These tools do all the mathematical calculations for you and give you an accurate result ensuring that you save time and direct your energy towards other Important things.

We all know that time is money and that saying is applies more to someone who trades currencies! Having helpers and tools that save you valuable time is essential to trading and lot size calculators are an invaluable tool that helps traders regularly.

Source: https://www.audacitycapital.co.uk/how-to-use-super-thinking-and-mental-models-to-improve-your-trading/

Lot sizes are very helpful for the market as they are very handy in regulating price quotes which then helps investors keep track of how many units they are purchasing of a singular contract and ascertain the amount they will be paying for each unit.

Any forex trader will eventually come face to face with these “lots” after they have had sufficient experience in the field and are getting more serious about their investments.

Furthermore, taking the time to calculate the right amount to be paid for lot sizes can also help you ascertain your profit or loss more accurately so allocating the right forex lot size is very crucial for fx traders.

Related Articles

Millennium Development Goals (MDGs)

How to Calculate Cross Rate of Exchange? Cody Walls Believe it or

The 3 Best Forex Signal Providers for 2022

The 3 Best Forex Signal Providers for 2022Cody WallsThe act of buying

Forex Exit Indicator: How to Exit a Profitable Trade?

Forex Exit Indicator: How to Exit a Profitable Trade?Cody WallsExperienced traders will