Forex Breakout Strategy: Understanding and Implementing in Your TradesCody WallsCapitalizing on the

Forex Breakout Strategy: Understanding and Implementing in Your Trades

It is a well-known fact that trading forex for a living can be a very lucrative career choice if done properly as profit and losses in forex are almost unlimited.

Traders are attracted to forex as there are so many platforms and currency pairs to choose from all of which provide you with the best opportunities to make good money.

One of the best things about forex is that complete beginners can enroll in an online course or just dive in straight and learn forex trading on their feet.

At the end of the day, your skills, your willingness to take risks, the strategy and tactics you are using, and most importantly, your ability to analyze and gather information from the market, etc all come into play when trading forex pairs.

That being said, let us take a look at ten important things that you should know about if trading forex for a living is your goal.

Source: https://www.ledgerinsights.com/hsbc-blockchain-forex/

Before you can even begin to trade for a living, you may have to trade forex for the kicks. What we mean by that is get a taste of how things work and do your homework before investing serious money.

Trading forex is a serious financial activity that takes place on the world’s biggest and most liquidated market to ever exist. This is why going in unprepared can be the quickest way of losing your money.

Having a blueprint in your mind with an alternative for every scenario will go a long way in helping you capture the best trades and make the smartest decisions on the fly.

Read books and visit forums and websites such as Forex Factory where experienced traders share their knowledge and tactics that they have picked up along the way.

You should familiarize yourself with basic terminologies used in forex, fraud detection and prevention, technical analysis, risk assessment, broker selection, etc.

You can choose to have a mentor or enroll in a class to get up to speed. It all depends on you!

Source: https://www.digilitimoney.com/merger

People who are currently trading forex for a living have one major advantage over beginners which is their years of experience.

This is where most beginners may get intimidated as they are aware that they might have to invest a significant amount of capital and sacrifice many years into this craft.

Fortunately, there’s a much less intimidating way around that which is called the demo account.

Many online brokers and trading platforms give their registered users an option to have a dummy account with fake money pre-loaded into it.

The purpose of the demo account is to let you gain all the experience you require as a trader without having to invest a single penny into it.

You can simply use the dummy currency and observe the results of your trades and learn from your mistakes.

The demo account is your trading simulator where you can practice what you have learned and learn from your mistakes while perfecting your craft simultaneously.

Once you have gained enough confidence and experience as a trader with the demo account, you can choose to move on to the real account and trade with real currency.

Source: https://www.marketwatch.com/story/5-insights-from-a-retail-trader-who-claims-he-parlayed-600-into-100000-2017-03-14

Forex pairs and their market values depend completely on their country of origin. Which is precisely why you’ll have to follow major global news portals religiously.

Every minor detail such as the current relationships between any two countries can cause fluctuations in currency rates.

This little window can be a very lucrative opportunity for those traders who can make correct predictions during these gaps.

However, this will only be possible when you have the correct data at your disposal.

Therefore, keep regular tabs on news outlets that are related to news about oil, trades, and commodities, the relationship between countries, embargos, etc.

Source: https://blackwellglobal.com/best-forex-broker-licenses/

As a forex trader, you must keep your emotions under control and treat fx trading purely as a business.

Your decisions have to be based on logic and reason rather than your emotions

Emotions can get in the way of your profits so beware. Train yourself and practice your steps over and over on your demo account until they are imprinted in your mind.

You’ll have to be cool as ice and hard as a rock to withstand any pressure that you face when trading forex for a living,

Source: https://www.mql5.com/en/market/product/40816

Beginners often get confused when deciding on the time frames of their entries and exits from any trade they are in.

Knowing when to stop is very crucial in forex trading just as knowing when to start is because that is where most of the profits lie.

The reason for all the confusion is that if you hold on to a position for too long and the market starts a downward trend then you’ll have to bear a loss due to your decision to hold.

Similarly, if you exit too soon and the position continues an upward trend then you end up losing that profit as well.

This is the reason why understanding entry and exit points are very important for any fx trader.

If you want to play it safe then using stops on your trades can be a good idea as they will automatically exit the trade for you after a certain level of profit is earned.

Source: https://www.investopedia.com/articles/forex/08/successful-trader-traits.asp

Expectancy can be defined as a means that lets you know the reliability of your system. This can be easily calculated with the help of a simple formula which is:

E=[1+(W/L)]* P -1

Where E denotes your expectancy, W denotes average winning trade, L denotes your average losing trade, and P denotes your percentage win ratio.

To gather the necessary data for this formula, simply look at your past ten trades and note down the required numbers that you derive from it and put those numbers into the above formula.

Source: https://ifpnews.com/why-do-you-need-a-forex-broker-to-trade-forex

Choosing the right broker is one of the most important decision you will have to take when you start your forex trading journey.

Only reputable brokers who are verified, have good reviews, have an excellent service record, and have all the necessary licenses should be considered.

After you have narrowed your list down, compare every feature that they offer and select the broker who appeals the most to you.

Their trading platform, user interface, forex pairs offered, analytic tools, etc should also be taken into account and compared.

Source: https://sites.google.com/site/blogstephenking1990/top-forex-brokers-ranking-2018

Your capital is the most important aspect of your long term trading endeavors.

You must treat the money you invest as extra money spending which won’t negatively affect your current lifestyle under any circumstances.

Being prepared to incur a few losses along the way will prepare you psychologically for the long journey ahead.

On the other hand, this will also help you manage your risk as you will be more focused on bigger trades while accepting the small losses you suffer along the way.

Source: https://financialoccultist.com/2019/06/16/forex-update-us-dollar-index-euro-gbp-jpy-cad-inr-aud-anirudh-sethi/

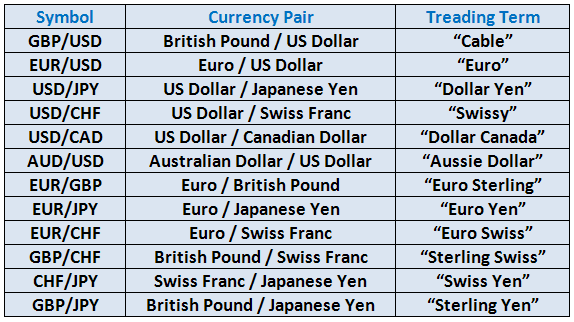

In forex, you are going to be trading currency pairs which is why it is really important to pick the right currency for your trades.

Some currencies are extremely volatile which attracts day traders in droves while some currencies are more suited for position traders who like to play the long game.

Which one you choose depends entirely on your risk appetite and strategy.

Refrain from investing in currencies that you are not familiar with. Doing proper research is guaranteed to give you more success in your trades.

Source: https://www.dailyfx.com/education/find-your-trading-style/forex-trading-journal-excel.html

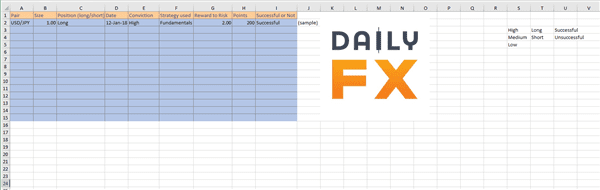

Maintaining a forex journal can help you keep track of all the successful and unsuccessful trades you’ve done so far.

Include all data including charts and all your conclusions regarding your trades.

Keep note of all the entry and exit points of the trades that you are keeping track of and analyze the data thoroughly.

Furthermore, don’t refrain from adding your comments and record the state of mind you were in whilst making that trade.

This can help you prepare psychologically for your future decisions as you will have prepared yourself mentally to tackle any difficult situation that may arise.

Recording and analyzing your data will also help you weed out any negative trading habits you may have such as being greedy or being impulsive.

Your trading journal can help you reflect on your past decisions and allow you to avoid making the same mistakes again.

Keeping the above points in mind will prepare you for the various challenges that arise when trading forex.

Trading is considered to be an art and the only way to get better at it is to practice and perfect your skills.

Keeping your capital separate and safe, employing the use of indicators and stop signals to exit a trade when the time arrives, choosing the right broker, doing proper research, etc are all part of the game.

Keep your head in the game and don’t let small losses catch you off guard. Prepare yourself mentally and you will be trading forex for living successfully for a long time.

Related Articles

Forex Breakout Strategy: Understanding and Implementing in Your Trades

Forex Breakout Strategy: Understanding and Implementing in Your TradesCody WallsCapitalizing on the

What is Spread in Forex Trading?

What is Spread in Forex Trading? Cody Walls Before attempting to understand

How to Read Forex Charts? – Beginner Friendly Guide

How to Read Forex Charts? - Beginner Friendly GuideCody WallsTraders need data