How to Use the Best Forex Trend Indicator Combination?Cody WallsA forex trend

How to Use the Best Forex Trend Indicator Combination

Anyone who has ever taken an interest in Economics must be aware that most of the time, the forces of supply and demand are responsible for the changes in prices of any commodity in an open market.

These commodities include everything from the rice that is grown by farmers to precious metals such as gold.

The concepts of supply and demand are straightforward yet highly complicated at the same time. Nonetheless, they are not that hard to grasp, and most beginners can easily work them out with ease.

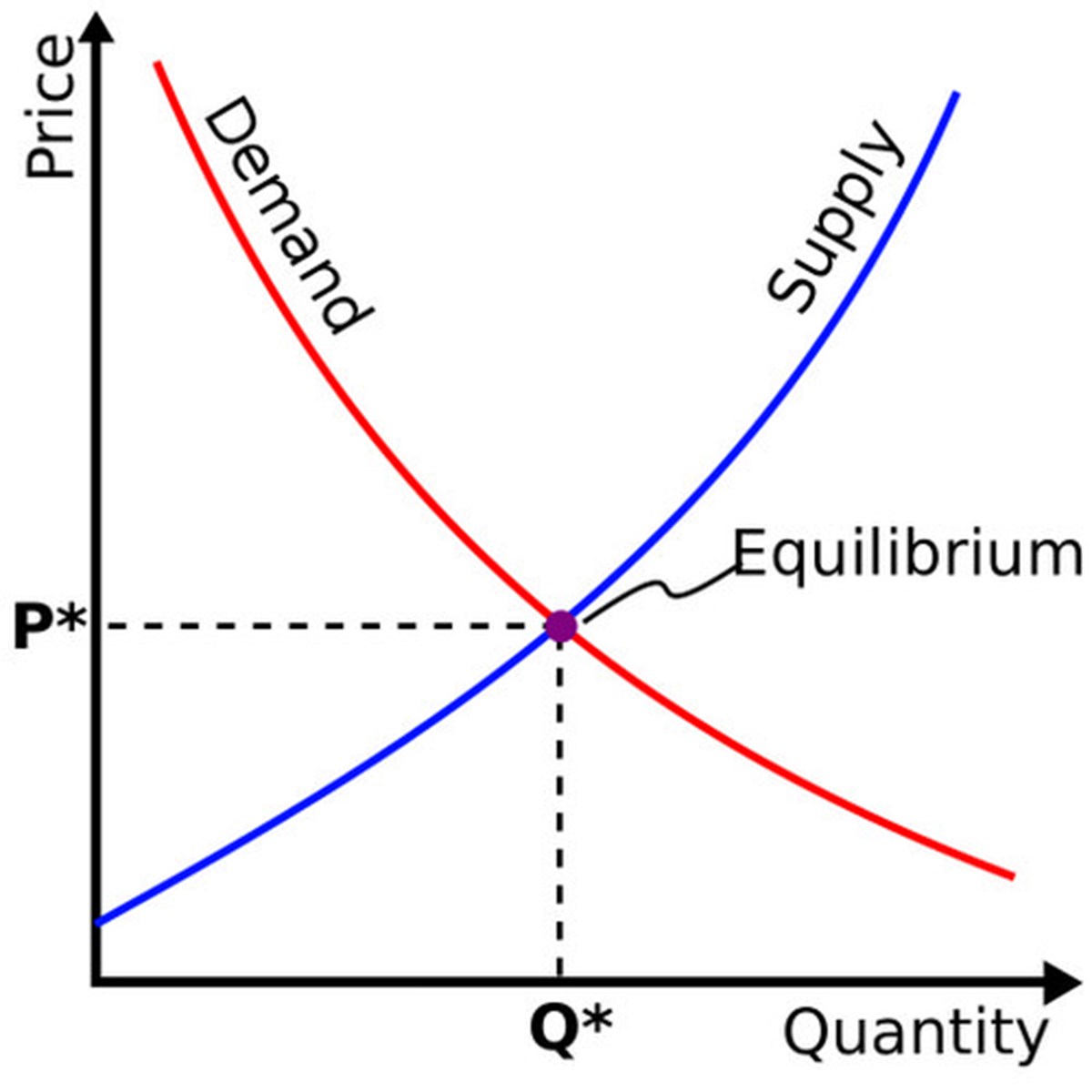

When the number of buyers outweighs the number of sellers, then the market price will automatically rise. On the other hand, when sellers outweigh buyers, the prices will fall.

Analyzing this pattern and combining it with other data gathered from market trends can help one ascertain the direction of future trends.

Forex traders who can navigate through the mazes of supply and demand have a better chance of predicting the movement of prices on the market and make better trading decisions.

What the supply and demand forex trading does is provide the traders with a simplistic system that aids them in identifying the entry price of a specific commodity without too much of a fuss.

With such a system, forex traders can easily identify the supply and demand zones, stop loss, level of profit, etc and predict market trends correctly.

Source: https://www.wallstreetmojo.com/supply-vs-demand/

Before we talk about supply and demand Forex trading, let us take a closer look at supply and demand first.

Let us learn from an example. If a company releases a product titled X at a fixed rate on the market and the buyers don’t agree with its price then they will have to reduce the price until it is reasonable enough.

Similarly, if product X starts to sell out then its price will have to move up as there is more demand for the product than its supply in the market.

Therefore, it can be said that buyers represent the forces of demand while the sellers represent the forces of supply.

Supply and demand work similarly for forex instruments such as all the currency pairs.

When buyers refrain from buying a certain currency then its price plummets to meet the demands of the traders. Similarly, it shoots up when everyone starts buying it.

Traders use the system of supply and demand forex trading to determine when the supply or the demand of a particular forex instrument will shift.

This data gives forex traders a huge advantage while they are trading and increases their chances of making a correct prediction regarding future market trends.

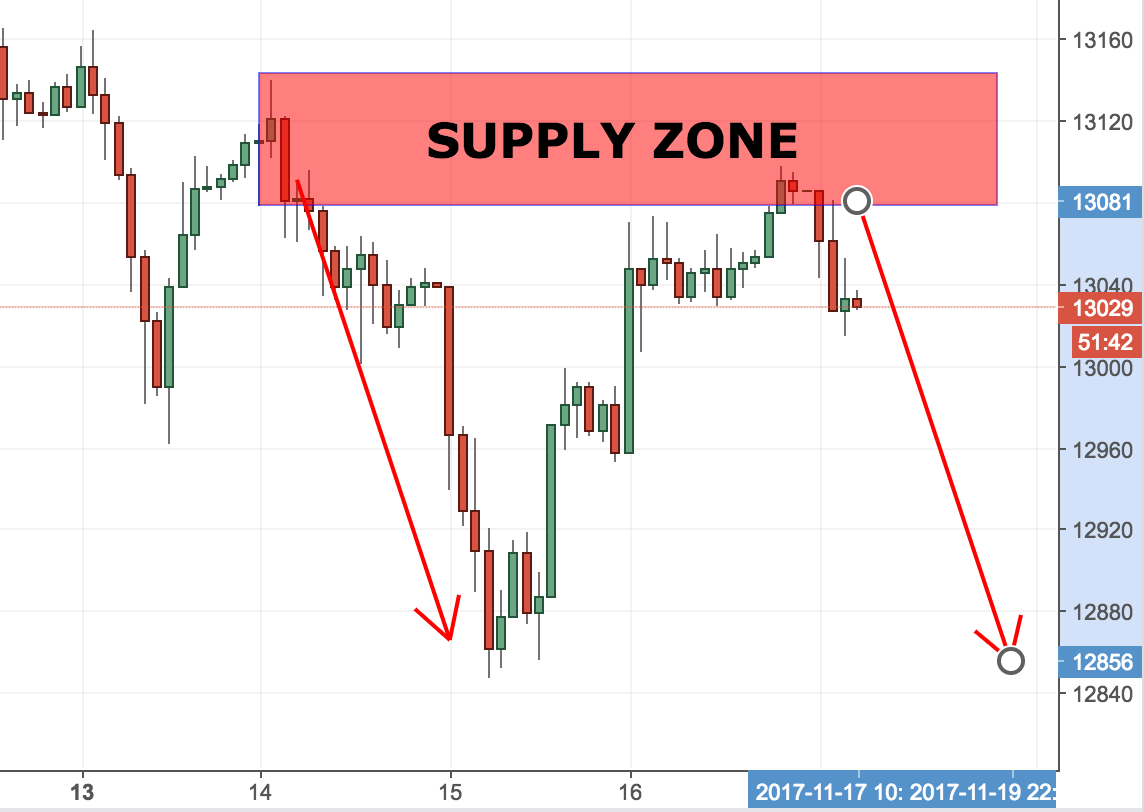

Source: https://www.colibritrader.com/what-are-supply-and-demand-zones-and-how-to-trade-with-them/

Traders need a graphical representation of any data that they extract to make some sense of it and the vast data of supply and demand is treated no differently.

When that data is represented in a supply and demand chart, the traders can identify the various zones of either supply or demand accurately.

Most notably, these zones crop up when there is said to be an imbalance in buyers or sellers which consequently creates a demand or a supply zone.

Source: https://fee.org/articles/the-law-of-supply-and-demand/

There are a few rules that traders follow indiscriminately when it comes to demand and supply fx trading. Making sure you understand the reasons behind those rules as they are the key to knowing how all of this works.

The most common rule followed by traders is to trade zones that are in the direction of the recent high or low. Trying to predict where the next zone will be can be a waste of time so try to follow the past trends.

Another thing to consider is the size of the move away. Don’t get too hung up on it as zones that have a big move away size are not much different than small sized ones. The thing to look for is the supply and demand zone with the rest of the trend.

Furthermore, always ensure that the prices return quickly to the trade zones on which you are treading on. Banks usually abandon the zones if the market of those zones does not return to its initial stage within a day.

Lastly, do not use old supply and demand zones for your strategies. They are more likely to be less successful so it is better to just move on to newer and fresher zones.

Source: https://www.saveallmoney.com/best-forex-trading-tips/

Try to use Forex indicators as well as a supply and demand chart to confirm support and demand zones.

Traders are known to incorporate daily as well as weekly pivot points and Fibonacci levels for such confirmations on the go.

So remember, charts and indicators are your friends in this kind of fx trading.

Another thing traders have to keep in mind is to exit when the time is right. A supply zone that is said to short-term that does not stay open for too long.

Shorter supply zones are also said to be the best for finding re-entries in case of a pullback.

One more tactic which is often used by institutional traders is called the spring pattern which works by finding a price direction in the opposite direction of the breakout.

Lastly, always try to place your profit target forward from the zone that you are targeting and set your stops outside the zone. That way you won’t have to forfeit your profits in case the open interest in that zone builds up.

Source: https://hackernoon.com/putting-a-forex-face-on-crypto-trading-could-help-it-go-mainstream-jx1xe324j

The pros of supply and demand fx trading: One of the best things about the supply and demand trading system is that the price levels are always pre-determined so you don’t have to do anything else other than setting them up.

This works to your advantage as you don’t have to waste time constantly looking at your charts and indicators to make the next trade.

Furthermore, the ups and downs of prices in such a system are easy to comprehend as they are dependent on the supply and demand that have already been studied and calculated by you before making the trade.

The cons of supply and demand trading: The only downside of this trading tactic depends on the way you are using it. You can’t trade forex using supply and demand as a standalone tactic.

You have to incorporate it into your trading style and combine it with other strategies and styles of trading that you have in your skill set.

Be sure to keep an eye out for the supply and demand zones and refer to the basic rules about trading them.

The only way to get this method of trading right is to practice it until you have mastered it.

Source: https://blog.goodaudience.com/the-12-golden-rules-of-crypto-trading-7474337a54d9?gi=29aa08f4fd7

Supply and demand fx trading can be rather easy for beginners to pick up and master since the rules of supply and demand are not that complex.

All you have to do is figure out the supply and demand zones after thoroughly analyzing the market trend based on the data you collect from previous trends.

Combine this technique with resistance and support levels to enhance it and get greater success in implementing it.

Related Articles

How to Use the Best Forex Trend Indicator Combination

How to Use the Best Forex Trend Indicator Combination?Cody WallsA forex trend

Olymp Trade Statuses: What Are the Perks?

Olymp Trade Statuses: What Are the Perks?Cody WallsOlymp Trade statuses are the

Olymp Trade Market and Platform Extensions

Olymp Trade Market and Platform Extensions - Complete GuideCody WallsOlymp Trade is