Forex Candlestick Patterns: Top 10 Patterns and How to Use ThemCody WallsCandlesticks

Forex Candlestick Patterns: Top 10 Patterns and How to Use Them

Veteran traders who have been active in the forex market for a significant amount of time must be aware of the fact that the forex market tends to repeat certain patterns every once in a while.

These patterns can be taken advantage of by the forex traders provided that they identify them in time before they are rendered useless.

Being able to determine the best time for entering a market is one of the most invaluable skills a trader can have as it helps them avoid losses.

Similarly, knowing when to exit is also an important skill that comes into play during trades because that is the best way to catch the highest price swing in that position which in turn gives you the highest possible profit.

There are various methods used by traders to determine such an exit point but predicting when possible trend reversals are going to take place is perhaps the best method.

Hence, it can be said that identifying possible forex reversal patterns on charts is the best bet for any forex trader if they want to master the trick of entry and exit points.

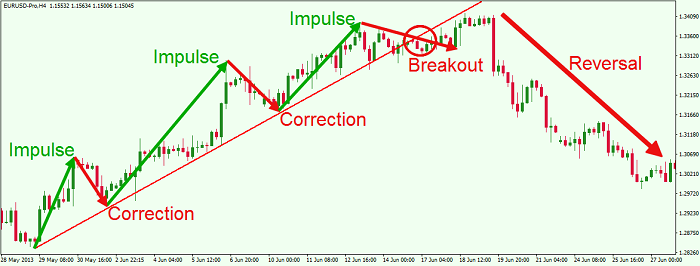

Source: https://forextraininggroup.com/how-to-identify-and-trade-with-the-trend-in-forex/

Forex trend reversals are nothing more than a collection of data represented on charts which are used to help an analyzer predict trend reversal zones that indicate when a previous trend is going to shift to a new one.

These chart readings or patterns help traders observe the level of importance the participants give towards specific currency pairs that you might be interested in.

A forex trend reversal can be represented in the form of candles in a variety of shapes specific to the chart or just be in the form of big anomalies in the case of a simple chart pattern.

Such reversals usually take place after some significant movement in the price of a forex instrument in the entire foreign exchange market.

Once identified, traders can move on to take advantage of the upcoming changes in market trends.

Source: https://virginiamnmuseum.com/examples-of-opportunities-and-risks-in-forex-trading/

Trend reversal in forex can either happen in an instant or take days to occur.

The various periods of a trend reversal affect different kinds of traders. For example, a trend reversal that took place within a day is of no concern to a position trader but it is of great significance to an intra-day trader.

Similarly, the trend reversals that take place within days or even weeks are of concern to a position trader but to a short term trader, it is a matter of no concern.

Source: https://www.naijatechhub.com/2017/09/forex-trading-for-dummies.html

It is a no brainer that spotting trend reversals will require you to spot the trend itself before its anywhere close to reversing. Traders take the use of market data and forex indicators to solve that problem.

Additionally, you can use a forex reversal pattern indicator to identify trend reversals as well. Some of those indicators are moving average, channel as well as oscillators such as the stochastics oscillator.

Other popular ways of isolating such an event are:

Trend Lines: Usually when major trend lines appear to be broken, there is a high possibility that a reversal is on the way.

While using various technical indicators in combination with the candlestick chart, there is a high probability of identifying trade reversals using trend lines.

Fibonacci Retracement: In this reversal isolating technique, the various price retracements will hover over Fibonacci retracement levels such as 38%, 50%, or 61%.

If the price is observed to be shooting past these levels, then that can be considered to be the signal of a trend reversal about to take place.

Pivot Points: This is also a method of identifying trend reversals in forex as well as in other financial markets.

The pivot point technique works by comparing downtrend as well as uptrend data.

If the lower support points during a downward trend break or if the higher resistance points during an upward trend break then that can be treated as a sign of an upcoming trend reversal.

Traders should keep in mind that reversals are not that easy to spot and require you to have significant skills and experience in trading.

It is pretty common for a trader to fall for a false signal from time to time. There might also be circumstances where a trend reversal takes place quicker than a trader’s reaction to it which might end up as a loss for that trader.

Source: https://admiralmarkets.com/education/articles/forex-basics/what-is-stop-out-level-in-forex

The best way of going about using a trend reversal pattern is to wait and confirm the pattern first as some of them might end up being a dud.

Be careful to not waste too much time waiting on them or they may slip out of your hands altogether!

That being said, there are a handful of forex reversal patterns that are known to occur from time to time during various fx trading sessions taking place on the market.

The reasons for their appearance depends on a variety of market factors such as market volatility, geographical instabilities, etc.

These frequently occurring patterns are given below:

Source: https://www.theselfemployed.com/article/what-you-need-to-know-before-you-begin-forex-trading/

Once a pattern has been confirmed and it looks like a trend turn-around may occur, the traders will immediately start looking for a price breakout that will head in the opposite direction.

There are multiple methods of trading a reversal. You could choose to go back to a support level or a resistance level to test the initial breakout level and take a trade afterward.

Traders can also watch out for a favorable area known as the neckline breakout which is an excellent forex reversal strategy.

The neckline breakout which happens to be an area of support or resistance that is diagonal is one thing that should be given priority during reversals.

Source: https://countandaccount.co.za/tax-implications-trading-forex-living/

Reversals in a forex market are an inevitable phenomenon as prices are bound to reverse sooner or later so having a skill that takes advantage of such a frequent occurrence can do wonders for a forex trader.

Needless to say, there are a few things that a trader should watch out for while using forex trend reversal patterns for their trades the most important of which are false signals.

So keep those in mind and practice your trades as that is the only way you can get better at identifying a pattern that will work out for sure.

Related Articles

Forex Candlestick Patterns: Top 10 Patterns and How to Use Them

Forex Candlestick Patterns: Top 10 Patterns and How to Use ThemCody WallsCandlesticks

7 Best Forex Trading Strategies for Beginners

7 Best Forex Trading Strategies for BeginnersCody WallsThe simple act of buying

Olymp Trade Education: A Good Resource for Beginners?

Olymp Trade Education: A Good Resource for Beginners?Cody WallsBesides being a highly