Forex Rollover Rates: How They Work with Example

The net interest rate on any currency positions that are said to be held overnight by forex traders is known as forex rollover rates.

The trader also earns or pays interest on the positions that he is holding overnight then that interest owing to the forex rollover rate.

Furthermore, it can also be said that the positive forex rollover rates are the interests accrued by the traders while negative forex rollover rates paid by traders.

It is common knowledge for every trader that the foreign exchange markets are closed globally on the weekends depending on the time zones that they are in.

However, that does not stop forex rollover rates as its value will still be counted for that closed period.

An interesting thing beginners should take note of is that day traders have no concerns with rollover rates because there are no interest rates to pay for a position that was closed within 24 hours.

However, position traders will have to pay or receive the interest that is owed or accrued on their respective trading accounts.

Let us take a closer look at forex rollover rates and understand how they work.

How Forex Rollover Rates Work

Source: https://www.iranfocus.com/en/economy/34199-iran-multi-tiered-exchange-corruption-results

Forex Rollover rates work by converting net currency interest rates into a cash position.

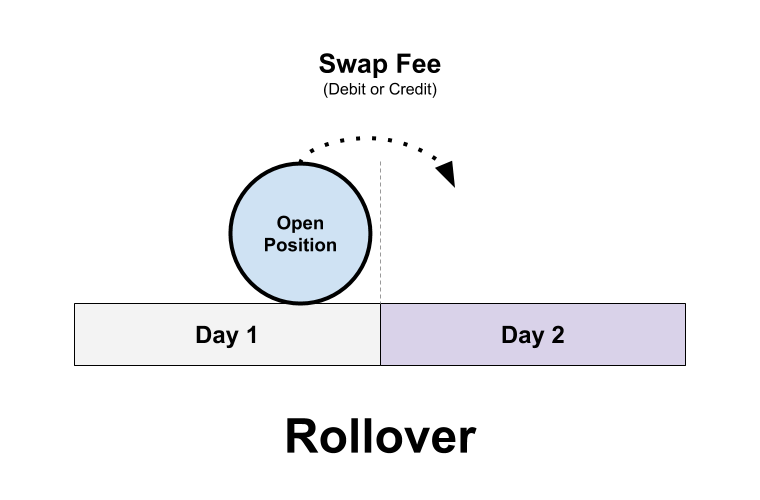

Rollovers for most forex traders essentially means that the positions are rolled over on a day-to-day basis until they close their positions or sell them.

Traders are usually required to receive the currency two days post-transaction as specified. If the position of the trader is short then they will receive a rollover credit.

Similarly, if the position of the trader is long on that particular trade then they will owe a rollover debit.

Fx Position Rollovers

Source: https://www.investopedia.com/ask/answeras/06/rollover.asp

In the case of long-term traders, it is somewhat easier for them to make profits on the market via the positive aspects of rollovers in forex.

All they need to do is calculate the difference between spot rates as well as the forward rates of the currency pairs that they are interested in.

These differences are known as swap points in fx trading and they are represented in pips (Point In Percentage).

Traders then make their profit when they are on the positive side of the interest rollover by calculating the swap points for specific delivery dates.

Calculating Forex Rollover Rates

Source: https://www.worldfinance.com/markets/fxtm-continues-to-thrive-in-the-unpredictable-world-of-forex-trading

Traders need to know the position size, currency pair, and the interest rate for each currency that makes up the pair to be able to calculate forex rollover rates accurately.

Then all one needs to do is subtract the interest rate of the base currency of that particular forex pair from the interest rate of the quote currency.

There’s no need to worry if you can’t tell which one is the base currency and which one is the quote currency.

Consider the pairing of the US dollar with the euro. This pairing on the foreign exchange will be represented as USD/EUR.

Now, the base currency in this pair is the first one which is USD while the quote currency is EUR.

Now that you have the subtraction of the interest rates of both base and the quote currency, simply divide that number by the base exchange rate multiplied by 365.

Exchange rates are the value of a currency vs the value of some other currency which is the USD vs EUR in this case.

Required to buy one unit of foreign currency which would be $1.14 in the case of the above pairing.

Net Gains And Net Losses

Source: https://born2invest.com/articles/forex-trading-tips-find-success-market/

Net gains and losses are rather simple to ascertain in rollovers.

For instance, if the profits generated in a long position trade on the euro currency is higher than the charge that comes by the USD being kept out of line on a short position, then the rollover is said to be a net gain for the trader.

On the other hand, if the interest rates are greater for the short position on the USD then the rollover is assumed as a net loss for the trader.

An Example Of Rollover Rate In Forex

Source: https://www.babypips.com/forexpedia/rollover

Traders who are not fond of manual calculations will be pleased to know that all major foreign exchanges display the rollover rate for everyone to see.

Now for the example, let us consider a fictitious scenario with the currency pairing of the USD with EUR.

The trader chooses to go long on the USD currency and short for the EUR currency. Let us keep the exchange rate at 0.69 for this scenario.

Assume that the overnight interest rate for the USD currency is 1.75% if that country’s Reserve Bank allows so.

Similarly, assume that the EUR federal funds rate would be at a level of 2.4% during this exercise.

The long interest is for a position at 100,000 would be at 9.3 EUR and 5.01 USD for the short USD position.

Converting the EUR to USD would give you a value of 15.53.

The USD/EUR rollover rate would come to be at a pip level of 0.26 pips. Therefore, the rollover rate at 100,000 notional stand at-2.6 in USD or -3.8 in EUR.

Using Forex Rollovers

Source: https://www.dailyfx.com/education/why-trade-forex/understanding-forex-rollover.html

Forex traders can use rollover rates to their advantage by following a few tricks and strategies.

For starters, if there is any indication that the rollover rate is going to be vastly negative in your favor, close the position before 5 p.m EST.

Similarly, if there are any indications that the rollover rate is going to be in your favor then keep your positions open even after 5 p.m EST.

Furthermore, keep a sharp eye out on all forex related news portals as well as the Central Bank Calendar to catch rollover condition changes before they take full effect and ruin your profits.

Conclusion

Source: https://iqoption.com/lp/mobile-partner/en/?aff=27635&afftrack=&clickid=&aff_model=

In conclusion, the only downside of using rollover rates is that the difference between the investor’s rollover rate that he has calculated and the fx charges can be slightly volatile.

Keep in mind small but important things such as checking the Central Bank Calendar of the country whose currency pair you are trading in and keep practicing your positions.

Português

Português  Indonesia

Indonesia  Thai

Thai  Tiếng Việt

Tiếng Việt  Italiano

Italiano  Français

Français  Deutsch

Deutsch