Live Traders Review: Is Live Traders Legit?Cody WallsLive Traders is the name

Live Traders Review: Is Live Traders Legit?

Forex traders are known to use various trading methods using price patterns to find entry points and stop levels for their trades.

This helps them take the most logical trading decisions based on hard data that has been derived with the help of thorough technical analysis.

Popular forex chart patterns used in these scenarios are the head and shoulders and the triangle pattern, which provides visual information for the trader to analyze and decipher.

Since the foreign exchange is such a huge market that offers numerous currency pairs to the traders, traders develop their niche and style using a handful of patterns that they are comfortable with.

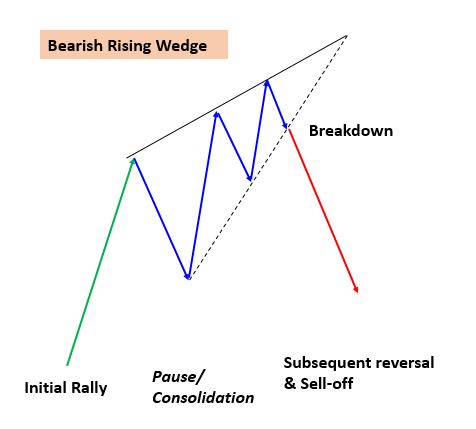

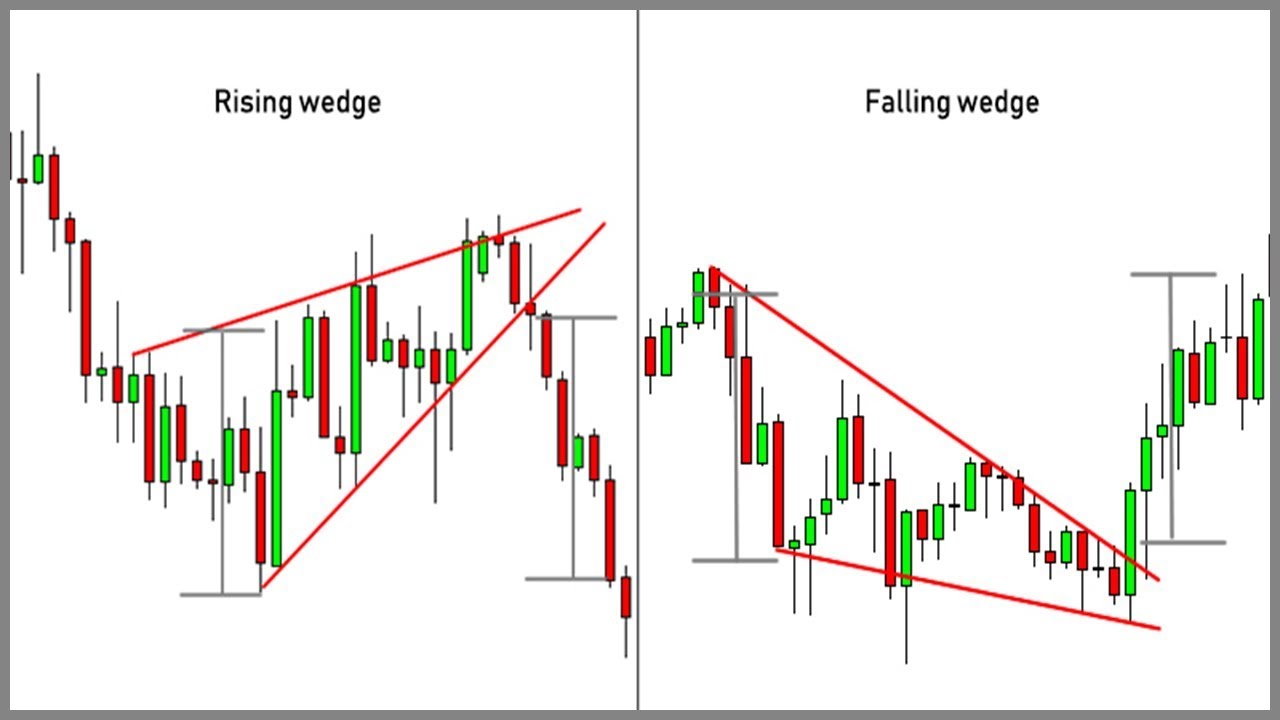

The rising wedge and the falling wedge are two useful trading patterns that supply the trader with visual cues and other necessary information crucial for trading.

In a nutshell, the rising wedge is a reversal pattern that makes it easier to predict the price trend movement in the market once observed.

Similarly, the falling wedge pattern can be beneficial in predicting upcoming bullish trends in the market.

Let us take a closer look at both these patterns and understand how they work.

Source: https://www.accendomarkets.com/research/education/wedges-bullish-and-bearish/

This pattern is alternatively called the ascending wedge and is usually found by traders when they are tracking market prices. This pattern is usually bound between two upward trend lines.

They are also known to form during the rise or fall of the market trends during regular everyday trade sessions without.

The rising wedge’s attribute is that it is a bearish chart formation and traders making use of the rising wedge can count on it to point out both reversals as well as continuations of patterns in the market depending on the market conditions.

Similar to the heads and shoulders pattern, the ascending wedge pattern can also lead to breakouts which are bearish most of the time.

It is common for inexperienced traders to look at this pattern and mistake its characteristics for a bullish trend since each peak is usually higher than the last peak.

However, it is important to observe the fact that the rising moves get smaller with each succession which is the hallmark indicator of a bearish trend forming up.

Source: https://www.youtube.com/watch?v=n101HtrJ_eE

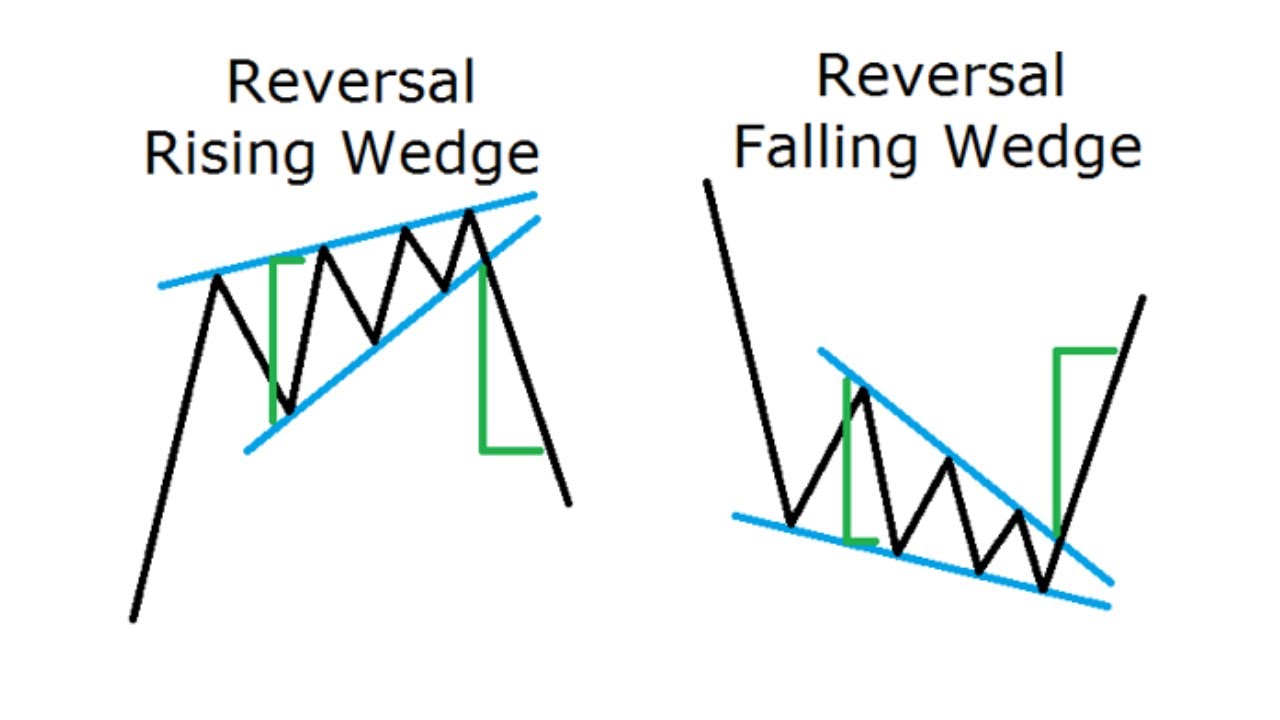

Since the falling wedge is a pattern that is associated with bullish trend continuations or reversals in the market, there can be some confusion regarding its readings on the forex charts.

What you need to do to be able to successfully identify the rising pattern is to look for an established downtrend and try to find the rising wedge formation.

You can also try linking lower highs with the higher lows via trend line to see if they converge towards a narrow point or not or you can look for a break below the support line for short entries.

Source: https://tradingstrategyguides.com/wedge-trading-strategy/

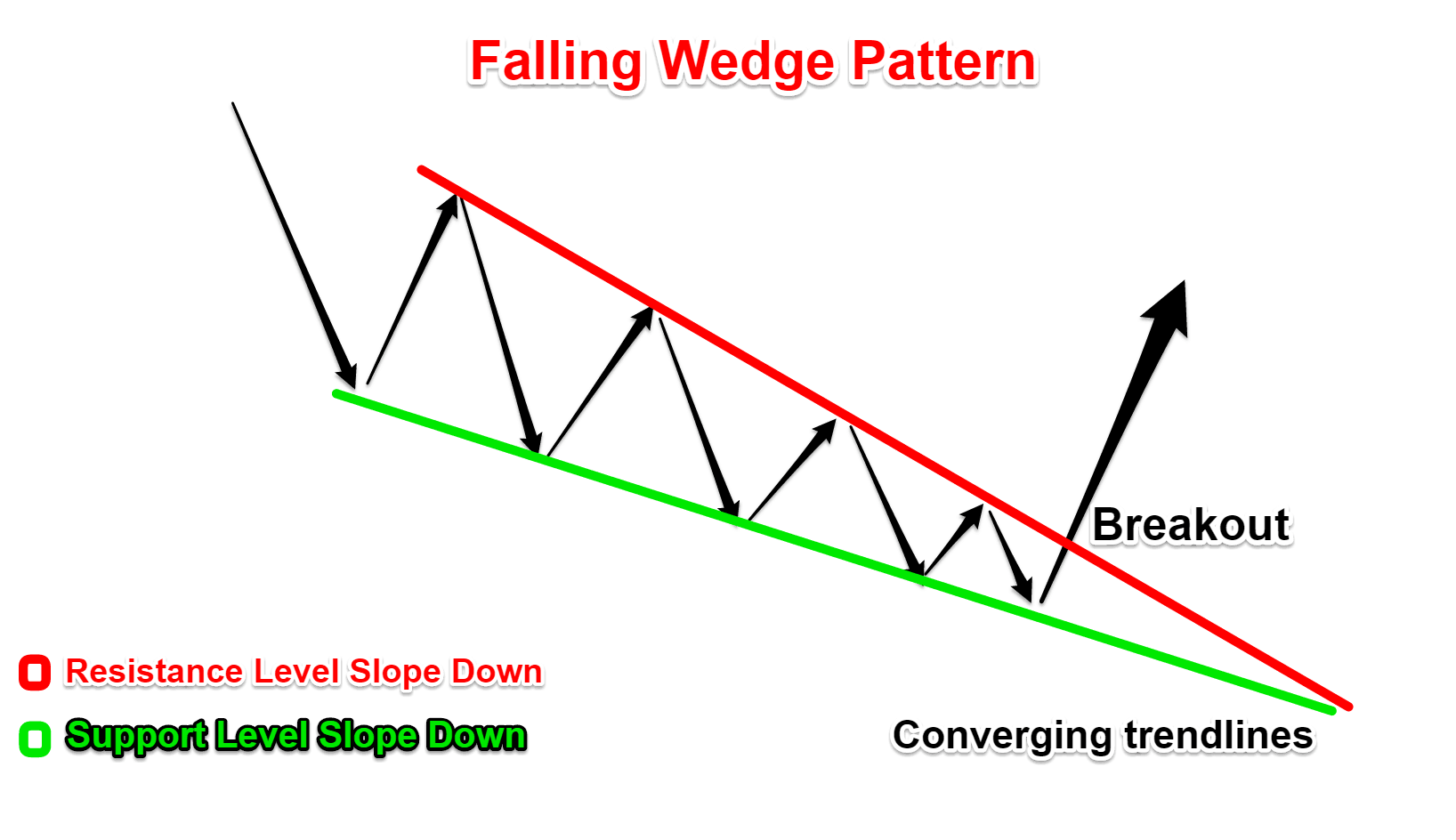

The falling wedge pattern is a continuation or reversal pattern depending on the situation which forms between two downward-sloping trend lines that are said to be converging on each other with the price bouncing off from it.

It is alternatively called the descending wedge and is considered to be a bullish chart formation, unlike its counterpart.

Similar to the ascending wedge, the descending wedge can also indicate patterns of reversal as well as continuation-depending on its position in the market trend where it pops up.

Interestingly, the downward wedge, much like its counterpart can also lead to breakouts but since they are opposite of each other, the downward wedge leads to bullish reversals instead of bearish ones.

Furthermore, falling wedges are quite notorious for breakouts which can be easily detected using the proper forex charts and indicator tools.

Source : https://www.dailyfx.com/education/technical-analysis-chart-patterns/falling-wedge.html

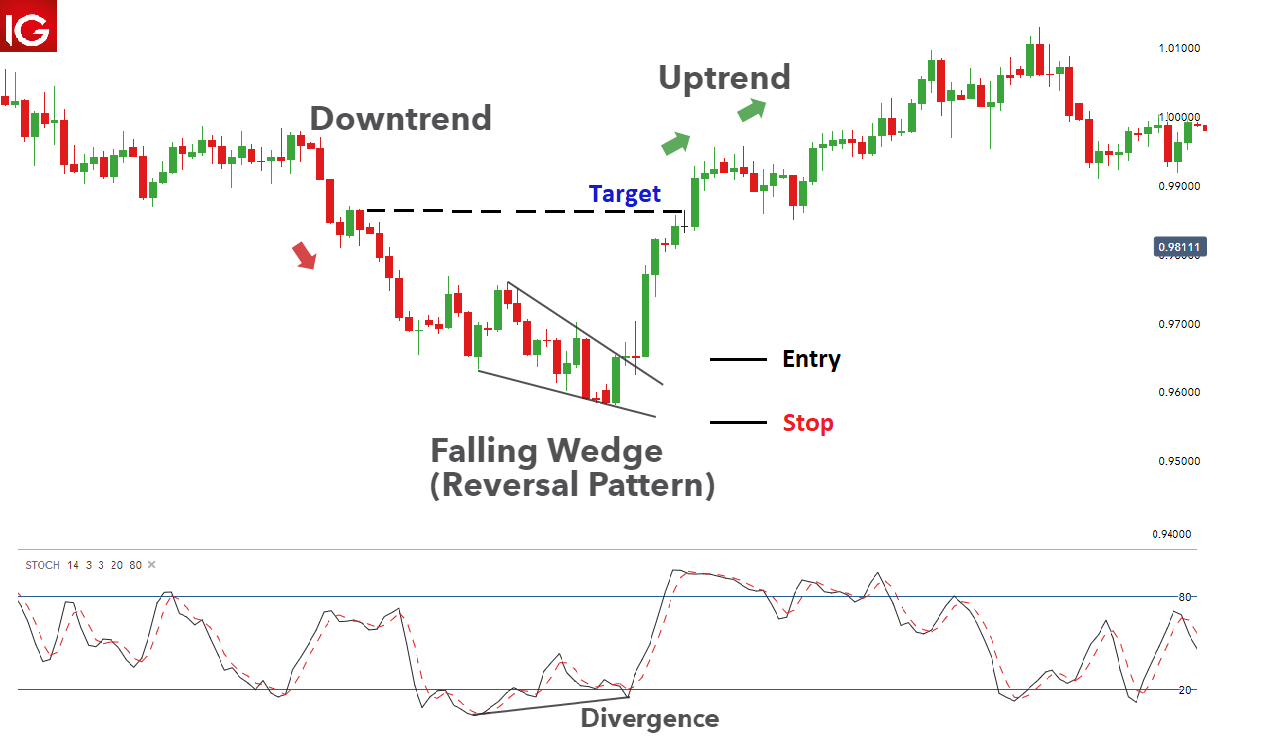

Like its counterpart, the falling wedge is also taken as a sign for upcoming trends. However, this one is associated with bullish continuations as well as reversals.

To spot this pattern, try looking for an uptrend or maybe even a downtrend, then link the lower highs with the higher lows with the help of a trend line to see if they converge in a downward slope or not.

Like the ascending wedge, you can use oscillators and other indicator tools to detect this pattern via oversold signals.

Lastly, you can try looking for a break above the resistance line to see if whether there's a long entry or not.

Source : https://www.youtube.com/watch?v=8NIUd8E1syY

There are a few crucial differences between these two patterns that you, as a forex trader, need to keep in mind while using them in your trading endeavors.

Source :https://www.forex.com/en-us/education/education-themes/technical-analysis/falling-and-rising-wedges/

Every strategy and tactic in forex trading comes with its pros and cons and the wedge patterns are no exception. Here are some of the major advantages as well as disadvantages that you will have to face when trading with it.

Falling Wedge Advantages:

Falling Wedge Disadvantages:

Rising Wedge Advantages:

Rising Wedge Disadvantage:

It is important to keep these factors in mind while trading with wedge patterns as they can come in handy while you are coming up with a strategy to get the best out of your trades.

Source: https://admiralmarkets.com/education/articles/trading-software/best-automated-forex-trading-software

Now that you are familiar with both these patterns let us look at the various trading strategies.

Traders who use breakouts are aware of the advantage it grants them, which is the advantage of getting the heads-up way before any move being invalidated.

The same advantage can be found in wedge trading as well.

Cut your losses by placing your stop loss based on previous market high readings before the pattern gets broken.

You can also even place your stop loss above the previous level of support, so if by any chance, the previous support does not turn into a new resistance level. You can easily quit the trade.

Breakout trading rules also apply in this strategy, where the support levels used earlier turn into new levels of resistance.

The other breakout theory that will come in handy in this strategy is to look for the range of the previous channel to predict the magnitude of an upcoming shift or move.

For example, suppose the rising wedge starts with resistance and support levels with 50 points. In that case, there is a high possibility that the market may lower 50 points as soon as this breakout happens.

It is essential to keep in mind the harsh fact that not every wedge, whether they're rising or falling, will turn into a breakout for you to take advantage of.

This is why confirming the possibility of a breakout is a must for every trader, no matter their level of expertise.

In the ascending wedge case, traders usually tend to settle for a move beyond a support point formed in the past.

Furthermore, try to keep a sharp eye out for random spikes in volume after a breakout as that is considered to be a good market sign which might entail some big moves in the future.

source: https://investor-square.com/investment-news/trading/the-trading-edge-has-to-control-yourself/

At the end of the day, wedges are nothing more than a part of the fundamental analysis phase of forex trading that traders use frequently to correctly predict the coming market’s situation and confirm if there will be a bullish trend or a bearish trend.

It is important to not get confused by the characteristics of both the wedge patterns meaning that descending wedges are associated with bullish markets and ascending wedges are associated with bearish markets and it is quite common for inexperienced traders to confuse the two.

While trading with wedges, always consider which strategy suits your style the best. Whether you want to keep your position open or if you want to cut your losses and take profits entirely depends on you alone.

Related Articles