5 Best Forex Account Management Services for Passive Income (2024 updated)

Having a managed forex account is becoming more common. Money managers use forex account management services to operate their clients' forex accounts and day-to-day trading decisions.

Even while the features of services vary from broker to broker, forex account management services provide their clients with several perks, like a free demo account.

Now let's look at some of the greatest service providers in this industry.

We'll also discuss what a managed forex account is, the many types offered by brokers, and the distinctions between managed accounts and copy trading.

5 Best Forex Account Management Services

There are dozens, if not millions, of fund managers who provide managed forex accounts.

We've done the legwork for you by compiling a list of the best managed forex accounts for 2024. You can learn more about their features, advantages, downsides, accepted countries and more.

No: 1

eToro

Biggest selection of free forex managed accounts

No: 2

Exness Social Trading

Best forex account management service for India

No: 3

IG Smart Portfolio

Institutional account management

No: 4

AvaTrade

Wide selection of MAM and other managed account types

No: 5

FXTM

Good social trading alternative

1. eToro

If you are familiar with forex trading, chances are high that you have already heard of eToro.

With over 20 million users, eToro is the world's largest social trading and investment platform.

However, most traders don’t know that eToro offers more than just social trading - the ability to copy other successful traders’ activities.

Two ways you can use eToro as a forex account management service:

Check out this short video to understand what account and risk management options you have with eToro and why we consider it the best option:

1. Copy Professional Traders - minimum deposit: $200

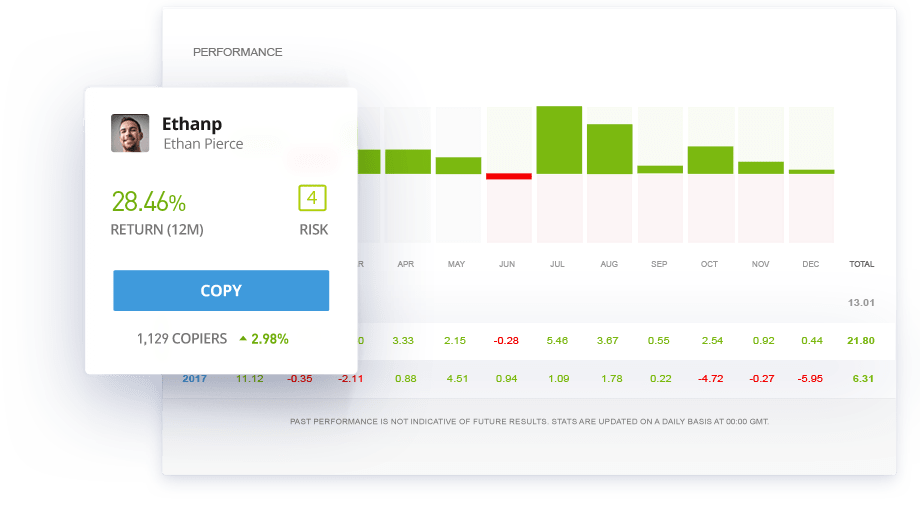

CopyTrade is eToro’s signature investment service, the main reason it became one of the most popular trading broker in the world.

CopyTrader is basically the “Facebook of online trading”, where each eToro member has their own profile page and news feed where they can discuss trading strategies and share tips, and insights with others. On this profile page, you can also see the past trading performance of the specific trader, and if you like his results, you can copy all of his future trades with a click of a button for free!

So if they buy or sell specific assets, eToro will automatically do the same on your trading account. In short, if the trader makes money, you make money, too.

Editors' tip for selecting the right traders to copy:

We only consider "Elite level" traders, people with a green star next to their names. They are professional traders who usually trade for a living and invest a significant amount of their own money. To reach and maintain an elite level, they have to:

- have at least $20.000 average equity (=their investment) on their account,

- manage at least $500.000 total capital (copiers' investments),

- and pass "advanced investment management qualification."

Open a free eToro demo account, go to "Discover" and start copying a few elite traders, risk-free.

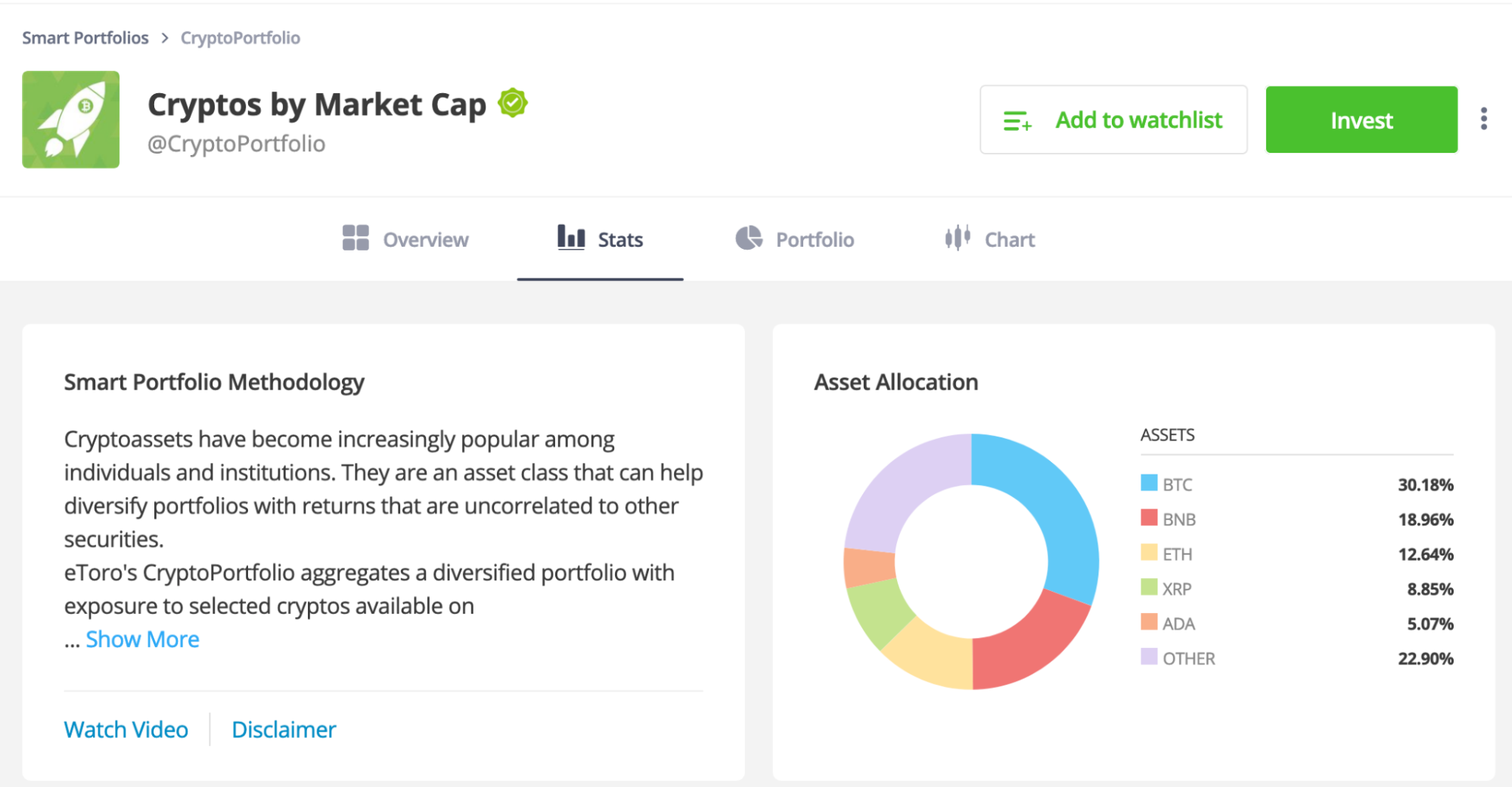

2. Smart Portfolios - minimum deposit: $500

Smart Portfolios are thematic collections of specific shares, commodities, cryptocurrencies, etc, that were curated by eToro’s expert portfolio managers.

It’s a safer, more diversified alternative to CopyTrader, however, the returns are usually much lower. It works similarly to an ETF, so if you pick for example the “Crypto Portfolio”, you will automatically buy a specific set of different cryptocurrencies.

As Smart Portfolios are frequently rebalanced, it is the ideal choice if you want to reduce your risk and responsibility, be a fully passive investor and let an expert manage your money - in exchange for less flexibility and profit.

Learn more about eToro Smart Portfolios here

Pros and Cons of eToro

Pros

Cons

NOTE: 79% of retail investors lose money trading CFDs at this site.

2. Exness Social Trading

Exness is a fully regulated trading broker that has been operating since 2008. It has licenses from regulatory bodies like CySec, FCA and FSCA. Exness is probably a less-known name in the online trading world, although you might come across their logo because of partnerships like they had with Real Madrid FC or other similarly big names.

Credit: https://www.realmadrid.com/

Exness only introduced social trading in March 2020 and attracted a lot of interest from traders worldwide. What distinguishes the Exness Social Trading platform from eToro? Let’s see.

3 reasons why Exness offers a great forex account management service for beginners

1. Exness is aimed at beginner investors with no investment ideas for stock trading and who don’t want to learn how to trade.

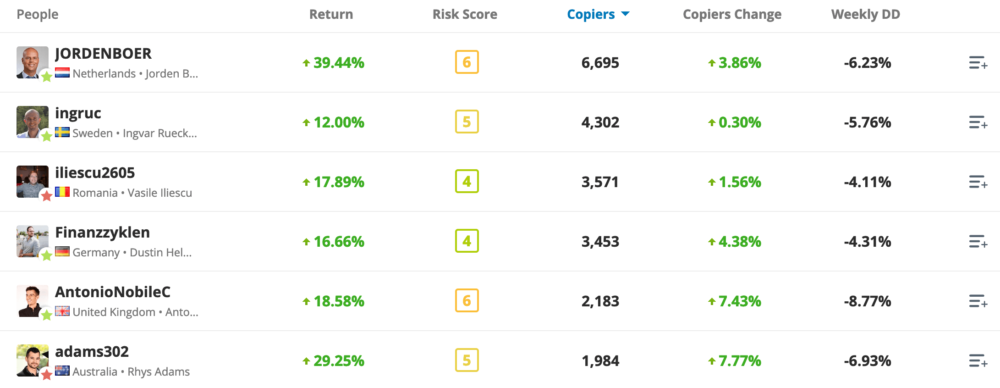

The social trading platform of Exness is a lot simpler than eToro’s. You won’t see a lot of charts and analytical information about the traders’ activities, and you won’t be able to influence your trading behavior by setting a stop loss, for example.

You can filter account managers / top traders by these things only:

Return %

Risk score (1-10)

Number of investors copying the trader

Country of the trader

Exness focuses solely on one thing: keep account management simple.

Here's an overview video on what the Exness investment platform looks like:

2. You can open a trading account with just $1.

This fact also emphasizes the goals of Exness: make investing easy and accessible to everyone. Besides the $1 minimum deposit requirement, there is basically no minimum position opening limit. You can copy trades with as little as 0.000000000001 lot of USD. Additionally, Exness has some of the lowest fees on the market when it comes to regular trading on the foreign exchange market.

3. Exness targets the “other half of the world” than eToro

While eToro is focusing mainly on top-tier regions like the UK, Europe and Australia, Exness bans those countries and makes trading available for India, Indonesia, South Africa, etc. There are only a few bigger countries like Brazil that both brokers accept.

Click here to see the list of available countries at Exness!

Editor’s tip: We think that eToro is the best option for forex account management, but if your country is banned, choose Exness, it’s a great alternative.

Exness trading account types

If you want to use Exness as a regular trading platform, they offer a wide variety of account types like cent accounts, zero spread accounts and more. All of them have one thing in common: very good trading fees.

However, if you are interested in using their social trading platform, you have generally three options to consider:

Important: your account level will be determined by your first deposit, so if you want to use the Pro account features, your first deposit should be at least $200.

1. Standard account - $1 minimum deposit

The standard account is great if you don’t have $200 to invest or if you just want to get a feel for the platform and test different strategy providers to see which ones are worth copying. It’s a good option for absolute beginners, but it has its limitations which is why we recommend the Pro account for most investors.

Note: You shouldn’t really expect any visible gains from investing just $1. If you plan to stay with the Standard account, we recommend starting with at least a $30-50 first deposit. This is just our recommendation, you have to decide about your starting capital based on your financial situation and goals.

2. Pro account - $200 minimum deposit

The Pro account gives you a few very important advantages compared to the Standard one:

Over 60% lower trading fees

Instant order execution

Unlimited leverage » you can follow any trader, even if they use huge leverage to make profits quicker (however, your risk will significantly increase)

30% margin call (60% for Standard accounts) » your open positions will have much better risk-torelance

Generally, if you go with the Pro account, your trades will be cheaper and you get a lot more flexibility on them.

3. Social Trading accounts - $500 minimum deposit

If your first deposit is over $500, besides getting the Pro account status, you automatically are eligible to be a strategy provider. This means you can create strategies that other people can follow and earn up to 50% of their invested money as a commission.

As Exness defines account levels based on the first deposit, if you plan to provide trading strategies anytime soon, you should consider depositing $500 or more.

Pros and Cons of Exness Social Trading

Pros

Contras

3. IG Smart Portfolio

IG is a heavily regulated FX broker registered with the CFTC (US), NFA (US), and FCA (U.K.) . It is one of the few brokers that accept U.S. clients as a regular forex trader.

However , their forex account management service - IG Smart Portfolio - is only available for UK traders.

IG Smart Portfolio uses iShares ETFs (exchange-traded funds) and actively managed portfolios created by BlackRock, the largest asset manager in the world.

It is a less dangerous and more reliable alternative than social trading, but you will likely experience slower growth, making it more suitable for long-term investors.

The minimum deposit is $250, and it is suitable for those who don't fancy choosing their investments.

Your portfolio will be fully managed by professionals, who will rebalance it when foreign exchange market conditions change to maintain it operating in line with your objectives.

There are five IG Smart Portfolios, which differ in terms of risk tolerance and investing goals:

Conservative portfolio: Investors that are either exceedingly risk-averse or have short-term goals should use this portfolio.

Moderate portfolio: It is made for investors who wish to safeguard their assets while also outpacing inflation over the long term.

Balanced portfolio: It is created for investors who want to gradually increase their savings while benefiting from the enhanced diversification that fixed-income instruments can offer.

Growth portfolio: It is intended for risk-averse individuals willing to accept significant volatility in the value of their holdings to achieve long-term growth.

Aggressive portfolio: To attain better long-term growth rates, it is intended for individuals with high-risk, high-reward investments.

Pros

Contras

4. AvaTrade

AvaTrade, also known as Learn2Trade, is a leading provider of managed accounts and a copy trading broker.

This platform provides a MAM account, comprehensive transparency not typically associated with brokers, and an excellent demo account.

The minimum deposit at AvaTrade is $100. AvaTrade is for novice investors seeking a basic understanding of forex and CFD trading.

Pros

Contras

5. FXTM

ForexTime, or FXTM for short, was launched in 2011. It is a global forex and CFD broker regulated by a few financial agencies and regulators.

ForexTime is a good alternative for forex traders seeking a managed forex account because their commission percentages are lower than most of their competitors.

Use FXTM as your forex account service provider because they have educated and competent money managers to handle your trading opportunities.

The minimum deposit at FXTM is $50. FXTM Invest is suitable for beginners, intermediates, and advanced traders.

Pros

Contras

What Is a Managed Forex Account?

First, a concise explanation of what a managed forex account is.

A managed forex account consists of depositing cash into a forex account and using a professional to trade those forex-managed funds on the highly leveraged forex markets.

A typical forex trading account is where you actively buy and sell currency pairs and make all the trading choices.

A managed forex account comprises a trading account where a trader or money manager trades on your behalf.

Clients often pay a commission to these forex account managers to take care of the operation of these managed accounts.

Remember that not all forex brokers are made equal, so before you open an account, thoroughly analyze your demands and broker characteristics.

Furthermore, if you want someone else to manage your forex trading account, be sure they have proper training and infrastructure and a good track record as a fund manager.

What Does a Forex Account Manager Do?

A money manager is responsible for various things, including:

- Managing the client's account investments

- Understanding how the forex market works

- In search of the best trading possibilities

- Risk evaluation

- Developing and implementing strategies

- Keeping the client informed at all times

Users have complete control over their accounts, while the money manager has limited access to them. The client's money is kept in a separate account.

They will usually charge a performance fee, so they only get paid when they make you money.

You give this trader a limited power of attorney (LPOA), allowing them to carry out transactions in your account on your behalf.

A forex account manager may transparently trade your money thanks to this power of attorney agreement.

Look for managers with consistent overall profitability combined with a relatively low maximum drawdown level.

How Do Forex Managed Accounts Work?

Managed forex accounts work by charging your forex investment procedures to a professional who will trade your capital alongside other investors' capital, buying and selling currencies.

A professional fund manager or financial expert will select your bids on your managed accounts and trade on your behalf.

You will only be charged a monthly performance fee based on returns.

You must make a minimum deposit and decide how much money you will put into the account each month.

What Are the Different Types of Managed Forex Accounts?

Three managed forex accounts are available through MT4 brokers and MT5 brokers.

- PAMM accounts (Percent allocation management module) PAMM accounts allow transactions to be distributed on a percentage basis on retail investor accounts. A PAMM account is the most frequent because it allows investors to have various account sizes.

- LAMM accounts (Lot allocation management module) The identical lot size is duplicated from the retail investor accounts in this system. It's the least common because both accounts must have the same size.

- MAM accounts (Multi-asset manager) A trader or account manager can allocate varying leverage levels to different investor MAM accounts. A MAM account makes it easy for money managers to execute block trades for multiple clients simultaneously.

Social Trading/Copy Trading vs. Managed Accounts: What's the Difference?

One of the most significant variations is that in a forex-managed account, a professional will manage and invest your money while keeping earnings cut.

In the case of hiring an account manager:

- You will have a one-on-one written agreement with him, so the process of setting up (and getting out of) this partnership is a lot more complex.

- The fund manager will actually execute the trades on your account, with your money.

- He usually takes a significant fee.

In copy trading on the other hand:

- You control your forex-managed funds and nobody else has access to your money.

- You can always decide to start or stop copying specific traders with a click of a button. There is no complicated setup process

- Copying other traders is usually either free or costs a lot less than hiring a traditional account manager

CopyTrader is an amazing free tool because you can choose from thousands of successful traders, but it is not a classic forex account management service, so it involves some risks.

With CopyTrader, it is not guaranteed that you will copy a professional trader, so it’s your responsibility to choose wisely who is going to manage your money.

The Benefits of a Managed Forex Trading Account

There are numerous advantages to selecting the finest managed forex account, whether one of the best forex-managed accounts listed above or from a different service.

- Time: Having a professional handle this for you, devoting their entire time to discovering the finest settings and expanding your managed account, is an excellent method to profit from the forex market.

- Control: One of the nicest aspects of the best-managed forex accounts is that you have complete control over investing and withdrawing.

- Safety: The finest forex-managed account will require you to deposit money into a managed account with a regulated broker.

The Risks and Downsides of a Managed Forex Trading Account

Any sort of forex trading is dangerous. It is a high-risk, volatile market. There is the potential for significant gains as well as significant losses.

However, the dangers of a managed account are smaller than those of individual trading. Nonetheless, no one can guarantee prosperity in the financial markets.

In copy trading, for example, you can alter the maximum risk level by subscribing to several forex traders and choosing the maximum loss size, after which the copying would stop.

A similar arrangement can be made with the money manager of your investment account. You won't simply hand over your managed account to a professional and walk away.

You can specify your level of risk and the techniques you want your account manager to employ.

Should You Get a Forex-Managed Account?

What level of involvement do you desire in the FX market?

A managed account may not be for you if you seek complete personal engagement and control over your forex positions and your own funds.

Managed accounts may be best if you choose to have a professional trade for you and risk your money according to their established trading strategies and software.

When you open your managed account, the fund manager you employ should screen you to identify your risk tolerance level and note any specific strategy instructions you may have.

How to Choose the Best Managed Forex Accounts for You

You must extensively research the best forex broker you wish to work with. Examine the broker's regulations, managed accounts, and overall reputation.

Who is in charge of regulating them? What are the broker's internet reviews like? Take the time to read internet evaluations from previous or present clients.

After that, thoroughly review the terms and conditions to verify that you and the forex broker are on the same page.

Frequently Asked Questions (FAQs)

Is Account Management Legal in Forex?

Forex-managed accounts are considered safe and legitimate because professionals carefully chosen by brokers oversee them.

Are Managed Forex Accounts Safe and Legit?

They are, indeed, safe. However, it is important to note that the forex market is volatile. Unexpected losses may occur.

Can I Have Multiple Managed Forex Accounts?

Managed forex is a type of trading in which you deposit funds into a managed account, and an account manager trades on your behalf.

You are free to open as many forex accounts as you wish. Working with only one or two brokers is the ideal approach.

Does a PAMM Account Make Money?

A straightforward, hassle-free way for people to select their own money managers for forex trading is through PAMM accounts.

Investors benefit from income with these accounts while putting in little effort.

However, depending on a money manager's performance, a PAMM account also risks experiencing a capital loss.

What Is a Currency Pair in Forex?

It is a price quote of the exchange rate for two different currencies traded on FX markets.

Conclusion

A managed forex account could be ideal if you want to engage in and profit from the forex market but don't want to trade on your own.

Even if someone trades on one's behalf, the account owner retains total ownership and can offer requests and feedback regarding trading techniques or selections.

Despite their convenience, a managed forex account can still be dangerous. Forex trading entails both significant risks and huge profits.

On the other hand, choosing to have the best forex-managed accounts will make your investments a little bit safer in the long term.

Português

Português  Indonesia

Indonesia  Thai

Thai  Tiếng Việt

Tiếng Việt  Italiano

Italiano  Français

Français  Deutsch

Deutsch