Olymp Trade Account Settings: Common Problems and SolutionsCody WallsIf you're an amateur,

Olymp Trade Account Settings: Common Problems and Solutions

Highly volatile currencies can end up being a good thing for Forex traders. This list will help you identify the 10 most volatile Forex pairs, the reason behind their volatility, forex pairs with the highest daily range, and how you can take advantage of them by looking at the factors that make them unstable.

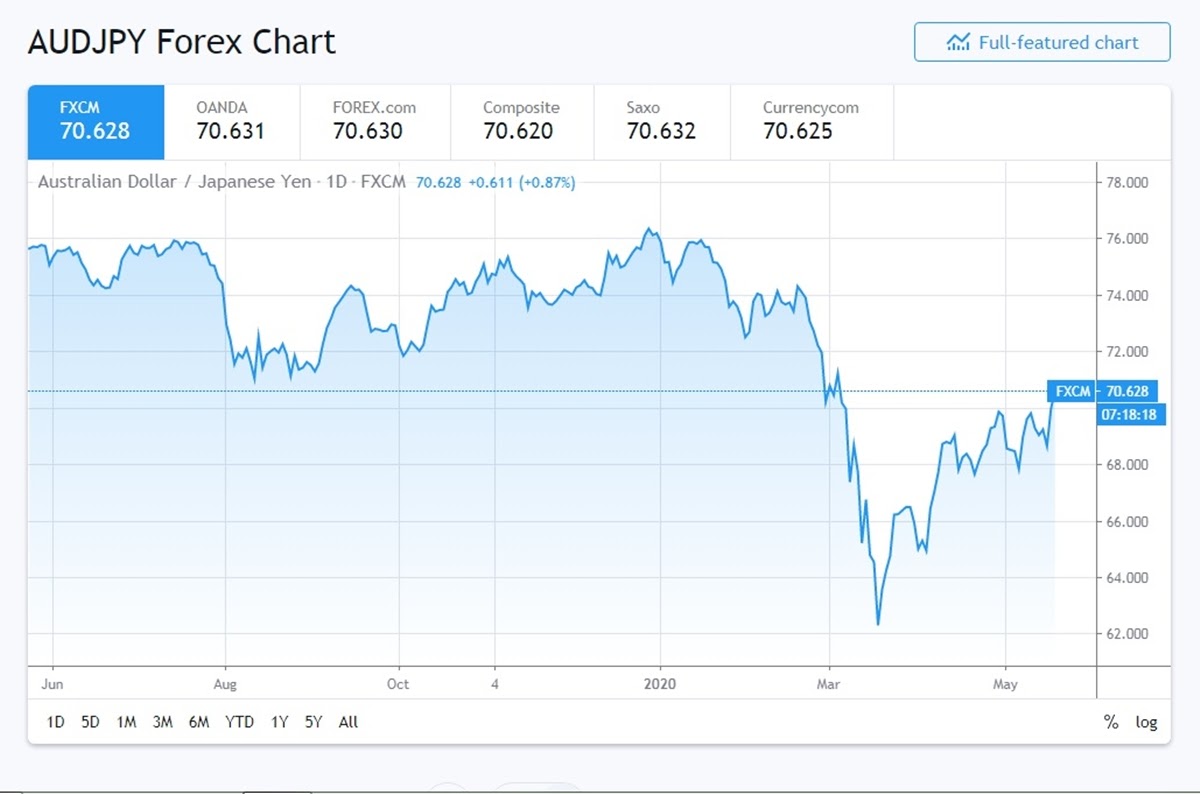

The Australian dollar and the Japanese yen pair are considered to be one of the most volatile currency pairs due to the opposite natures of both the countries’ economies and trading environment.

One can say that the Australian dollar is the currency of commodities since the price of their currency is tied to their capacity of exporting minerals and metals.

Agricultural products also play a small role in the price of their currency.

On the other hand, Japan is a country that has always relied on technological advancements. Investors usually tend to go towards the Japanese yen when they’re expecting an economic crisis.

Thus, due to their opposite natures, the price of this pair can be very radical.

Trading in this pair depends on the current economic conditions of both these countries as the yen is considered to be a safe currency that can be depended upon during times of crisis.

Source: https://in.tradingview.com/symbols/AUDJPY/

Both the Australian dollar as well as the US dollar are considered to be the most famous pairs in the entire trading world.

The reason for their high popularity is the interest rate differential of this particular pair although that has been on a decline due to current economic conditions which has been affecting their prices.

Since the US has been battling the Covid-19 outbreaks their economy has taken a significant blow. With 1.54 million confirmed cases and over 90,000 deaths, the US had no choice but to implement nationwide lockdowns which further affected their economy.

Both the Australian as well as the American government has been issuing stimulus checks for those out of work due to the lockdown.

Australia will be in lockdown until May so the economy is expected to be in a deep slumber until then.

Source: https://in.tradingview.com/symbols/AUDUSD/

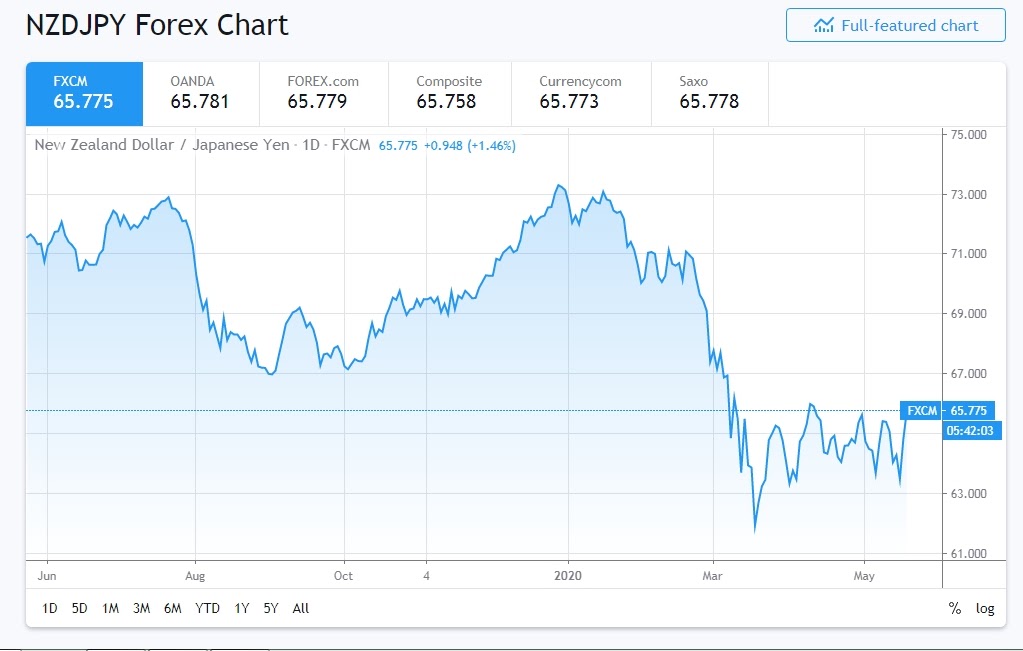

The New Zealand dollar and the Japanese yen pair is also said to be a volatile pair in terms of forex trading.

New Zealand’s economy is dependant on its ability to export commodities such as dairy products, honey, and wood while Japan is the world’s second-largest developed economy based around a free market.

Any changes in the prices of the market will influence New Zealand dollar’s value as compared to Japanese yen so keeping an eye out on the commodities and their prices will help you draw out successful trade strategies.

Source: https://in.tradingview.com/symbols/NZDJPY/

The British Pound Sterling or GBP is the official currency of the United Kingdom. GBP/EUR is the pairing of the British pound against the euro.

The reason why these major currency pairs have made it on this list is because of Brexit. The British pound sterling has been rather volatile since Brexit debacle began.

It was predicted that these pairing will become more stable after the withdrawal agreement would pass which happened on the 24th of January of 2020. So keeping an eye our for Europe Union and Britain related news is sure to give you keen insight on the price jumps.

Source: https://www.xe.com/currencycharts/?from=GBP&to=EUR

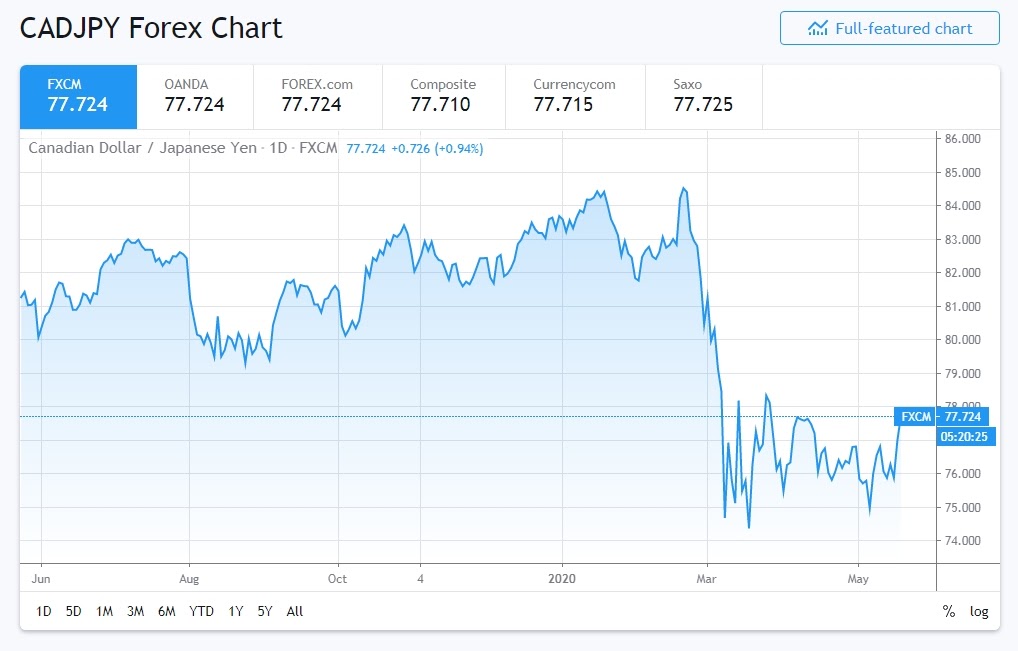

Another volatile Forex pair is the Canadian dollar against the Japanese yen. The Japanese yen is seen as a safe haven currency while the Canadian dollar is classified as a commodity currency.

The value of the Canadian dollar depends on the price of crude oil on the market and Japan also happens to be an exporter of the said commodity.

Therefore, if the price of oil jumps on the market, buying Canadian dollars with yen will become costlier due to the fact that more yen will be required to be converted into Canadian dollars to buy a barrel of oil.

Hence, traders interested in this forex pair should keep themselves up to date with oil market news and prices as that is the main factor behind CAD/JPY’s volatility.

Source: https://in.tradingview.com/symbols/CADJPY/

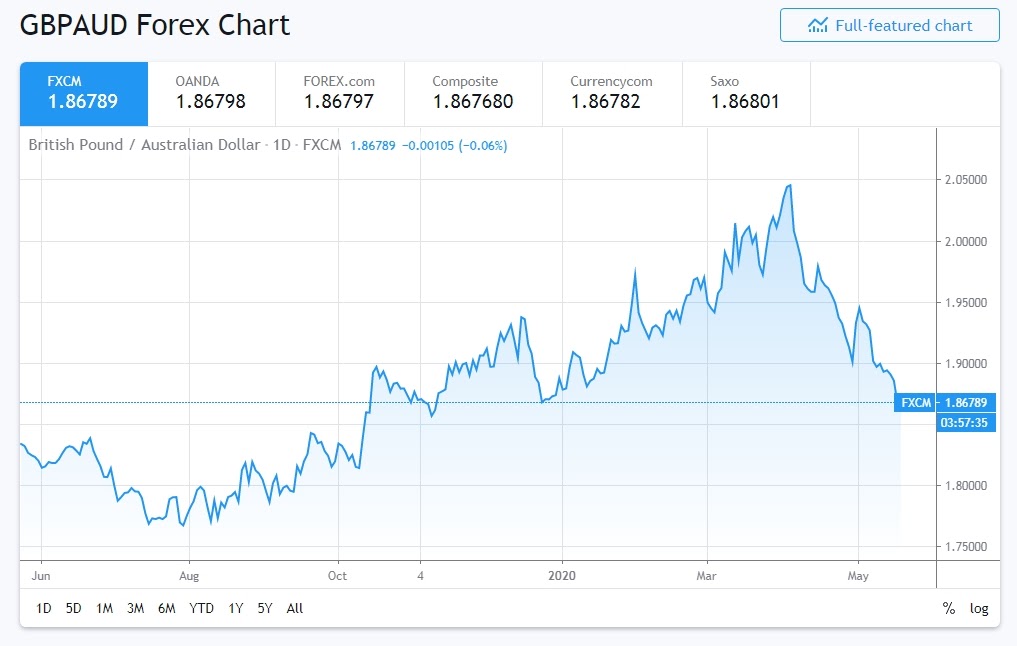

The Pound Sterling paired with the Australian dollar is another currency pair that has known to be volatile due to the Australian economy’s dependence on commodity trades.

Currently, the US and China have been locked into a trade war which has directly affected the Australian market as China is a crucial trading partner of Australia.

Numerous Australian exporters, as well as manufacturers, are heavily dependent on the Chinese traders and the recent trade war has put a dent on that trade relationship.

Even the Brexit situation had made this pairing even more volatile although that situation might be on a recovery road as the long-awaited withdrawal agreement was drafted in January.

Source: https://in.tradingview.com/symbols/GBPAUD/

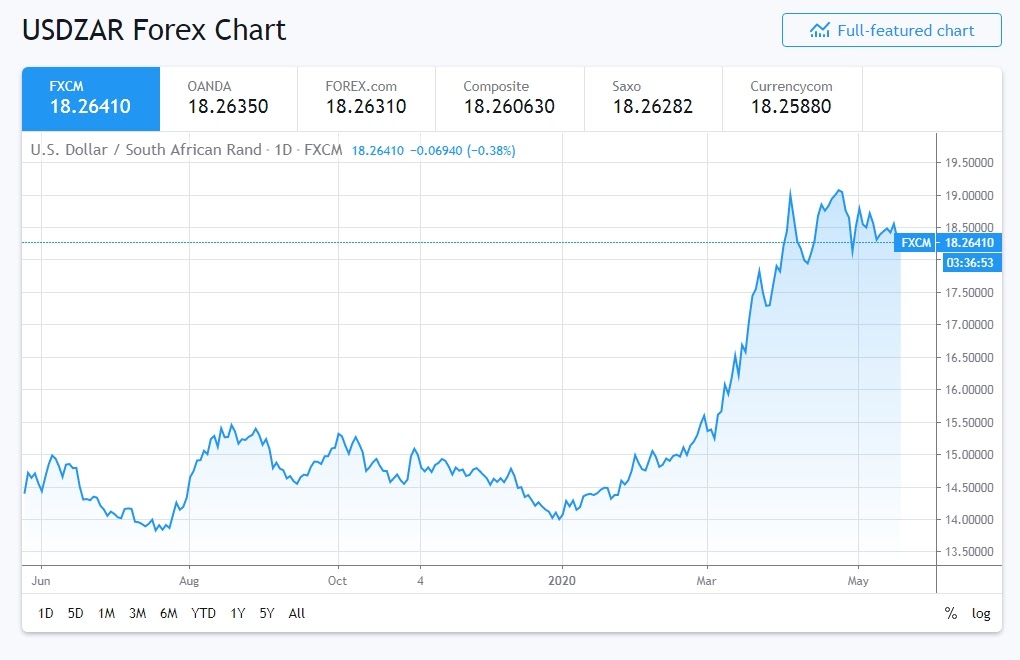

This is the pairing of the US dollar with the South African rand. The number factor that makes this pair highly volatile is the rising and falling prices of gold.

South Africa is one of the major exporters of gold which is priced in US dollar currency on the global market. Therefore, South Africa’s gold export is directly tied to the US dollar.

If the prices of gold rise then the price of US dollars will consequently rise as well. This gives South Africa more revenue on the global market for its gold.

To master this Forex pair, aspiring traders should learn the gold market inside out and prepare for every factor that will directly or indirectly affect the gold prices.

Source: https://in.tradingview.com/symbols/USDZAR/

The US dollar and Brazil’s real is a pair that is famous for being quite volatile with its prices.

Brazil is a developing market with many opportunities for traders as well as scalpers who can take advantage of the frequent price movements of this pair.

However, the political climate in Brazil has been known to be volatile which has led to accusations of corruption which went on to harm their economy.

The presidential elections of 2019 in Brazil led to a 2.63% dip in real’s value against the dollar so political conditions of the country need to be thoroughly analyzed to trade successfully in this currency pair.

Source: https://www.xe.com/currencycharts/?from=USD&to=BRL

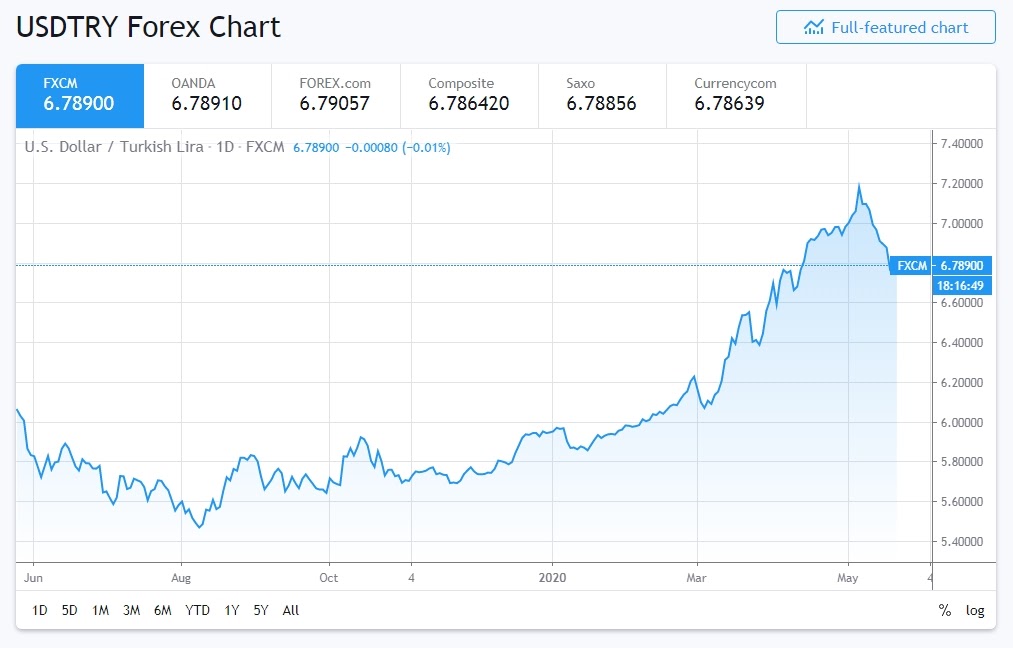

The Turkish lire has earned the title of the world’s most inflated currency ever since an unsuccessful coup d'état in 2016 that left their economy in shambles.

Paired with the US dollar, the pair has observed to be highly volatile in terms of trading.

Forex traders often target the USD/TRY pair to make a quick profit exploiting the highly volatile nature of the Turkish lire.

Source: https://in.tradingview.com/symbols/USDTRY/

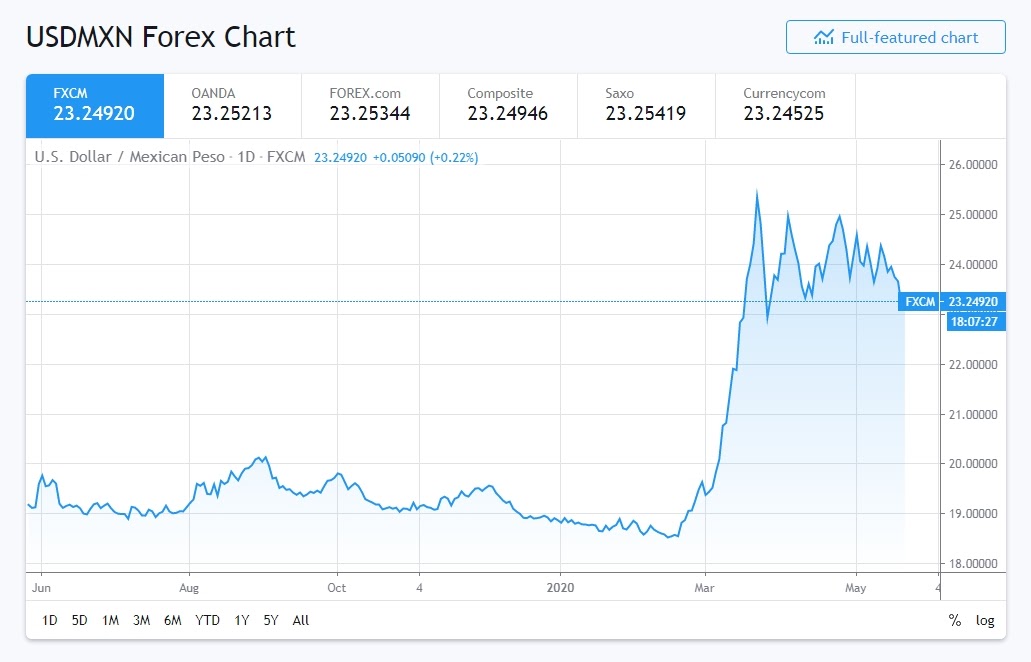

The US dollar against the Mexican peso is another volatile Forex pair owing to the rising tensions between the two countries ever since the 2016 presidential elections.

Immigration policies by the US government and the numerous tariffs issued by the Mexican government on all exports to the US have further added to the volatility of the USD/MXN currency pair.

Traders should note that the 2020 elections will ensure that this pair stays as volatile as ever. Following all the proposed policies as well as Donald Trump’s election strategy can be the key that could unlock this Forex pair’s potential.

Source: https://in.tradingview.com/symbols/USDMXN/

Related Articles

Olymp Trade Account Settings: Common Problems and Solutions

Olymp Trade Account Settings: Common Problems and SolutionsCody WallsIf you're an amateur,

Forex vs. Futures: Differences You Should Know

Forex vs. Futures: Differences You Should KnowCody WallsForex has become an integral

How to Deposit Money in Olymp Trade? (Complete Guide!)

Olymp Trade Deposit: Minimum Amounts, Methods, Fees and Potential Issues Cody Walls