Neteller Review 2022 – Is NETELLER safe to use in India?

Neteller is one of the best e-money transfer companies on the market today. Fast, simple, and secure have been the pillars of this company’s business for over a decade.

Neteller is a trusted digital payment platform whose deposit methods, prepaid Mastercards, and VIP levels make it stands out among all others, read on to find out more.

Neteller India Review

Firm | Paysafe Group Ltd. |

Official Website | |

Since | 1999 |

Regulation | Financial Conduct Authority (UK) |

Platform Type | E-Money/ Transfer |

Mobile Platform | Yes |

Compatibility | Mac OS, Windows, IOS, Android |

Mac OS, Windows, IOS, Android | Yes |

Neteller fees

Deposit Fee | 2.5% |

Transfer Fee | 1.45% |

Currency Exchange Fee | 1.29-3.99% |

Withdrawal Fee | $10 - $12.75 |

Transfer Limit | $50,000 – $2,000,000 |

As one of the world’s largest independent e-money transfer companies, Neteller processes billions of dollars in transactions each year from millions of clients. Trusted by businesses and consumers because of its wide array of financial services. Customers have chosen Neteller as their method to send and receive money as well as get paid online.

Pros & Cons

To sum things up, the services of the Neteller e-wallet can be broken down to the following advantages & disadvantages:

Pros

Contras

What is Neteller?

The Neteller digital transfer service and e-wallet run by Paysafe Financial Services Limited: founded in 1999. Paysafe Financial Services Limited was brought about to give businesses and individuals a trustworthy online payment method.

Paysafe Financial Services Limited, a subsidiary of Paysafe Group Limited, is authorized to issue e-money by the Financial Conduct Authority under the Electronic Money Regulations 2011.

Is Neteller Safe & Reliable to use in India?

Neteller maintains remarkably high standards as it is authorized by the Financial Conduct Authority in the UK. Its pioneering security measures combine physical and electronic security measures to protect members from identity fraud and theft.

This service provides its customers a method to move money around the world securely and privately, while giving businesses the opportunity to become global by accepting payments and making payouts almost anywhere.

With a multitude of online and offline withdrawal and spending options; users appreciate instant access to their cash at millions of point-of-sale (POS), ATMs, and online locations.

Neteller operates under UK laws set by the Ministry of Finance. The company is solely permitted to perform online transactions. It must keep each account’s balance stored in a separate bank account, meaning the company cannot lend money.

Security in Practice

Neteller has over 20 years of experience with electronic transfers and completing online transactions. In that time this company has continued to work to create the safest platform on the market. Your personal and financial information are guaranteed to be kept private for every deposit and withdrawal.

Furthermore, Neteller employs the cutting edge of encryption technology to secure all of its data. To bolster its security this company has implemented the “Verified by Visa” and “Mastercard SecureCode” authentication processes. Each deposit made through a Visa or Mastercard, Neteller’s security protocols require a predetermined password to be entered to guarantee there are no fraudulent transactions carried out on the platform.

What Makes Neteller Special?

Through Neteller, customers’ accounts can be in 26 different major currencies. Money can be loaded from a bank account, credit/debit card, or through around 40 other methods. These deposit types vary depending upon the country and some are instant.

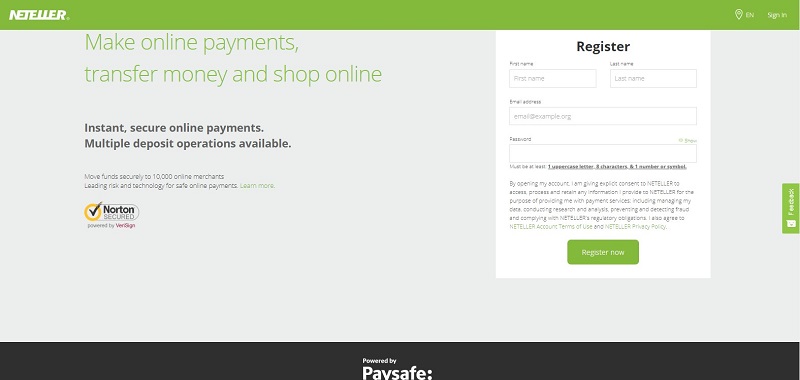

Registration for a Neteller account begins on the company’s homepage. Money can be sent directly from a company into users personal accounts, such as trading payouts, online winnings, etc. Pay businesses, send money to other users, or shop anywhere Mastercard is accepted using the Neteller prepaid card linked to the account.

Neteller Virtual/ Prepaid Card

Neteller offers its users virtual and prepaid cards to make purchases on and offline. Virtual cards change each time they are used to prevent the users’ information from being stolen.

The Net+ Prepaid Mastercard offered by Neteller can be used for cash withdrawals at thousands of supported Mastercard ATMs worldwide. The card will function as a normal Mastercard in any brick and mortar stores. The Net+ Prepaid Mastercard operates as a debit card. Therefore, the available balance of your card will always be the same as your Neteller e-wallet account balance. Join the Silver VIP level or higher to increase withdrawal limits for your Mastercard, and the initial fee will be waived.

The Virtual Prepaid Mastercard is an online version of the physical Prepaid Mastercard. To shop online,there is no need to receive a physical card. Alternatively, details are created for a virtual card in your Neteller account.

Card Fees

- With the Net+ Prepaid Mastercardthere are no monthly, annual, or inactive fees. The card can be ordered through a trader’s account for a one-time processing, shipping and handling fee of €10.00.

- There is a 1.75% fee for ATM withdrawals. Paying in shops at a POS (point of sale) is free when the currencies match, otherwise you are charged with a 3.99% fee.

- To avoid foreign exchange fees, choose the currency of the country in which the card will be used primarily. All Net+ fees are automatically withdrawn directly from your account. There are eight different currencies to choose from for your Net+ Prepaid Mastercard: AUD, CAD, DKK, EUR,GBP, JPY, SEK, and USD.

Your first Virtual Prepaid Mastercard is free and each subsequent card costs €2.50. Users are able to add up to 5 Net+ Virtual Prepaid Mastercards, with individual spending limits. There is a 3.99% currency exchange fee for when using different currencies.

Limits

- Net+ Virtual Prepaid Mastercard users cannot spend more than €6,300 over a 24 hour period.

- For non-VIP clients, the Net+ Prepaid Mastercard allows 4 ATM transactions, up to €900 total (or equivalent in another currency), 10 POS purchases, and €2,700 total on POS purchases.

- While Bronze VIP users can use 5 ATM transactions, up to €2,970 total (or equivalent in another currency), 15 POS purchases, and €6,300 total on POS purchases. These limits increase with each higher level of VIP.

- For unverified customers, the Net+ Virtual Prepaid Mastercard permits users to spend €180/ 24hrs with a yearly total of €720. Whereas verified clients are allowed 10 purchases/ 24hrs with a 24hr purchase limit of €6,300.

To learn more about the Neteller Net+ Prepaid Mastercard, head on over to the Neteller website.

Unfortunately for Indian traders, as of the end of September 2016, Neteller only offers Net+ Prepaid Mastercards to residents of SEPA countries.

Neteller: Sign Up/ Open an Account from India

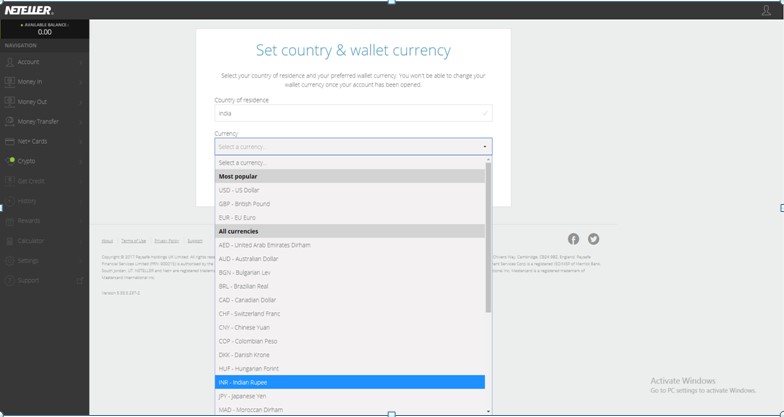

Becoming a Neteller client is simple from India; to open an account, fill in your name, email address, and create a password. Once open the country and currency must be selected: after a currency has been chosen it cannot be changed. Complete the KYC requirements to prove that you are a real person.

Neteller Account Verification from India

Complete the Anti-Money Laundering requirements with your name, address, and phone number. Once the information has been entered into the system the initial verification should be complete. After initial verification clients are able to deposit, transfer, and withdraw money.

3 ways to verify your account:

- Bank Account Verification – Go to the “Account Summary” section and follow the “Register Bank Account”. Present the details of your bank account including ΙΒΑΝ, the name of the city & country where the account was opened, the account’s currency, your branches phone number, SWIFT (BIC) code, and Government issued photo ID

- Address Verification – Upload a copy of an official utility bill (gas, water, or electricity bill). In the image your name and address must be clear and legible.

- Passport/ Driver’s License/ Photo ID Verification – Submit a scanned copy or photo of your ID or passport. Take your time and be sure to include a picture of both sides or all relevant pages.

How to Make a Neteller Deposit from India

In India, deposits are most often made by credit or debit cards. Traders who use Neteller in India deposits through credit/ debit cards or Paytm because Indian law makes depositing through a bank account difficult as bank transfers outside of India are rarely permitted. Cards are not subjected to the same regulations allowing investors to capitalize on Neteller’s international prowess. Paytm can also be used to load money into a Neteller account.

Internationally deposits and withdrawals could not be easier; with about 40 different options through which to load funds, anyone could make use of the account.

If you are unsure as to what will be the best possible deposit method for your country, create an account and look over the options available to you as laws differ from country to country.

How to Withdraw Money from Neteller to an Indian Bank Account

Customers can withdraw funds from their accounts by bank transfer, check, or using the company’s Net+ prepaid Mastercard at a point-of-sale or ATMs.

For most users, especially those in South East Asia, money is typically withdrawn to the same payment method or card used to deposit money. In India, this is most often a credit or debit card.

Depending on the account or personal card the money is being withdrawn to, it can instant or take a few days.

Neteller VIP

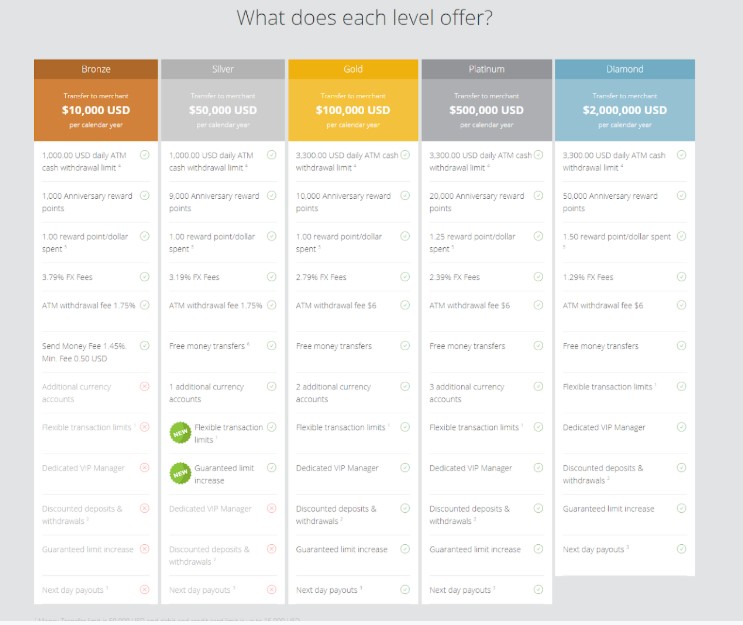

This platform provides users with 5 levels of membership, each with benefits ranging from dedicated support, lower fees, and higher transaction limits. All levels include Dedicated VIP Managers, lower fees for deposits & withdrawals, and more.

Bronze allows users a merchant transfer limit of $10,000 USD per calendar year. As the most basic level customers receive a 1,000.00 USD daily ATM cash withdrawal limit. Members earn 1,000 Anniversary reward points each year, along with 1.00 reward point/dollar spent. Fees start at 3.79% for currency exchanges, 1.75% for ATM withdrawals, and the fee to Send Money is 1.45% with a minimum charge of 0.50 USD.

- The Bronze level works for individuals looking to make casual use of this account.

Silver members are able to transfer $50,000 USD per calendar year. ATM cash withdrawals are also limited to $1,000.00 USD per day. Customers receive 9,000 Anniversary reward points each year and 1 reward points for every dollar spent. Free money transfers, lower fees (3.19% FX fees and ATM withdrawal fee 1.75%), and one additional currency account with flexible transaction limits gives users looking to move money in two currencies a perfect account.

- Silver is a great level for people trading on two or more platforms using different currencies.

Gold clients have a transfer limit of $100,000 USD each calendar year. Further setting this level apart are Neteller’s second-highest ATM cash withdrawal limit (3,300.00 USD/day), 10,000 Anniversary reward points, 2.79% FX fees, and a flat ATM withdrawal fee of $6. Users are given access to two additional currency accounts, a personal VIP account manager, lowered deposit & withdrawal fees, and next day payouts.

- This account is great for moderately high volume traders using multiple currencies for trading, traveling, and more.

Platinum – $500,000 USD can be transferred per calendar year. Users at this level have all Gold level privileges and 20,000 Anniversary reward points with 1.25 reward points/dollar spent, 2.39% foreign exchange fees, and 3 additional currency accounts.

- A level for high volume traders transferring to accounts around the world.

Diamond – the last but certainly not least appealing tier touting a 2,000,000 USD per year transfer limit, 50,000 Anniversary reward points with 1.50 reward points/dollar spent, and 1.29% exchange fees.

- Building off of Gold level privileges, this level is for the international business mogul you want to be.

Neteller and Trading

Traders around the world and India turn to Neteller because it is one of the online payment methods that allows its users the most flexibility. The company’s close ties with trading platforms across the globe permit traders to often have immediate deposits and withdrawals.

Once linked to your trading account on a platform like Olymp Trade investors can deposit and withdraw money with ease. This ease of deposit and withdrawal has lead the charge for traders looking to better their online trading experience.

With Neteller’s variety of VIP levels there is something for every trader, and as transaction volume increases so does their level.

Neteller Mobile App

The mobile app allows customers to send, spend, and receive all while on the go. Available on both the Apple App and Google Play Stores, it is a great way to ensure access to the full functionality of your account at all times.

Control your Net+ Mastercards on the go, raise or decrease spending limits on the fly. With an RFID enabled phone your app becomes your card where wireless tap payment is accepted.

Neteller’s app puts more control in the hands of clients, making it a must-have for all users.

Conclusion: 97/100 – Recommended

Neteller stands out above its competition in part thanks to the company’s determination to be the fastest, simplest, and most secure transfer service in the world. Client security, the network of online merchants, and the Net+ Mastercard combine to create the best service package of any transfer platform.

Various levels of membership allow people to maximize their use of Neteller by providing perks based on an individual’s needs.

Check out Neteller today and stop letting your money be restricted.

Português

Português  Indonesia

Indonesia  Thai

Thai  Tiếng Việt

Tiếng Việt  Italiano

Italiano  Français

Français  Deutsch

Deutsch